Introduction: Understanding the Market for Retirement Schemes

In the world of retirement community development, knowing your market size is crucial. At Carterwood, we focus on households where the Household Reference Person (HRP), defined by the ONS as the head of the household, is 65 or older. This age group is vital for assessing retirement scheme opportunities.

The Shift from 2011 to 2021 Census Data

Over the last decade, market size estimates for retirement schemes have relied on the 2011 census data. However, with the elderly population’s notable increase, these estimates likely undervalued the actual market size. The 2021 census data brings a much-needed update, revealing a significant jump in the number of HRPs aged 65 and over – from 4.08 million in 2011 to 5.1 million in 2021, marking a 25% increase.

Age Cohort Analysis: Where is the Growth?

- 85 and Over: The largest proportional increase at 43%.

- 75 to 84: A 25% increase.

- 65 to 74: The smallest proportional increase at 20%, but the most significant in absolute terms.

This data highlights the expanding market, especially for those entering retirement communities around the age of 80.

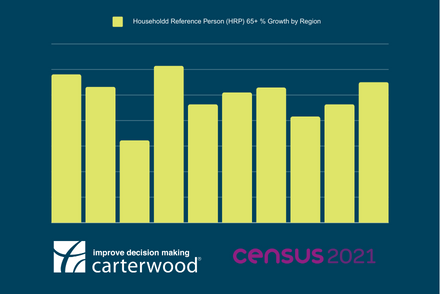

Regional Insights: Diverse Growth Across England and Wales

Each region shows unique growth patterns, with increases ranging from 20% to 30%. Notably:

- North East: The highest percentage growth.

- South East: Consistent with the national average and the largest absolute increase.

- London: A smaller increase, yet significant given the historic under-provision of IRC schemes.

Note: Scottish data remains pending.

HRP 65+ Growth by Region – A Detailed Breakdown

Household Reference Person (HRP) 65+ Growth by Region by Carterwood Ltd.

Implications for Retirement Scheme Viability

The updated census data suggests that areas previously deemed marginal or unsustainable for market penetration may now be viable. For instance, a market penetration previously calculated at 10% might now, with a 25% increase in market size, drop to a more feasible 8%.

Conclusion: A New Landscape for Retirement Development

The 2021 census has reshaped our understanding of the retirement market. Developers and investors should re-evaluate previously overlooked markets, as the demographic shift opens new opportunities.