Author: Tom Hartley, director

As the care sector continues its journey into 2021, Carterwood – market analysts to the social care sector – present research that charts elderly care home openings since 2018. Trends in new home and bed openings are revealed, alongside the impacts of COVID-19 on the market, these factors undoubtedly influencing the future shape of the sector.

In this article, Carterwood also recognise the UK’s most active operators, highlighting those that have the highest number of bed openings within new homes in the past 3 years and also since lockdown 1 of the Covid-19 pandemic.

Quick links:

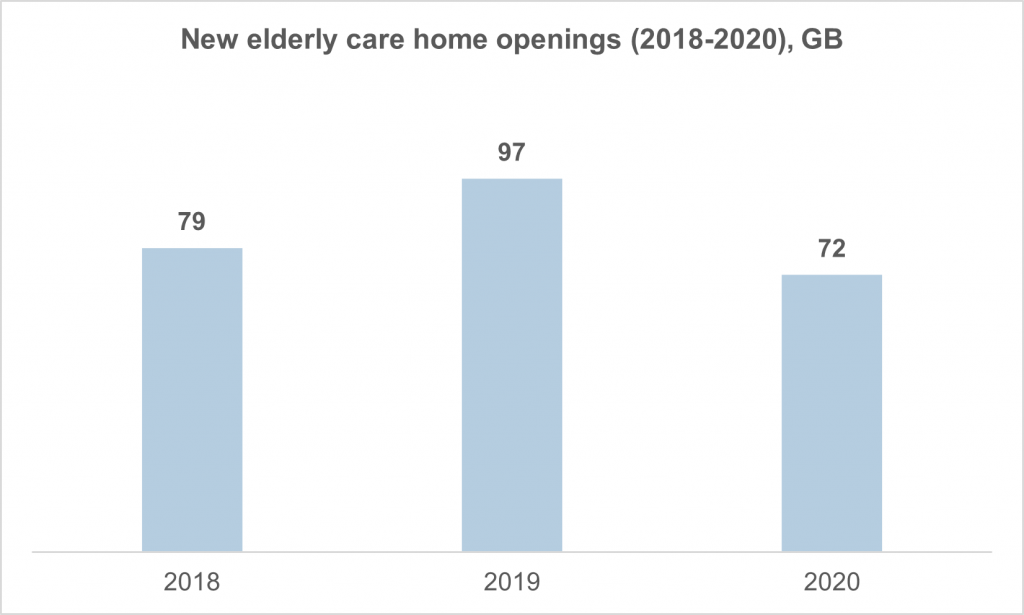

Care home openings in GB lower in 2020 than in 2018 and 2019

Before the COVID-19 pandemic hit in March 2020, elderly care home openings in Great Britain had increased markedly year on year, from 79 in 2018 to 97 in 2019. However, the impact of the global pandemic has been clear, with opening activity dropping back below 2018 levels to 72 in 2020.

Figure 1. Elderly care home openings (2018-2020), Great Britain

It is Carterwood’s view that the pre-2020 increase in openings would have continued under normal circumstances, with additional investment and development underpinned by significant levels of demand for market-standard elderly care home accommodation across Great Britain. Those underlying fundamentals have not changed, but concerns over the commercial viability of filling bedspaces during a pandemic have understandably put the brakes on that growth.

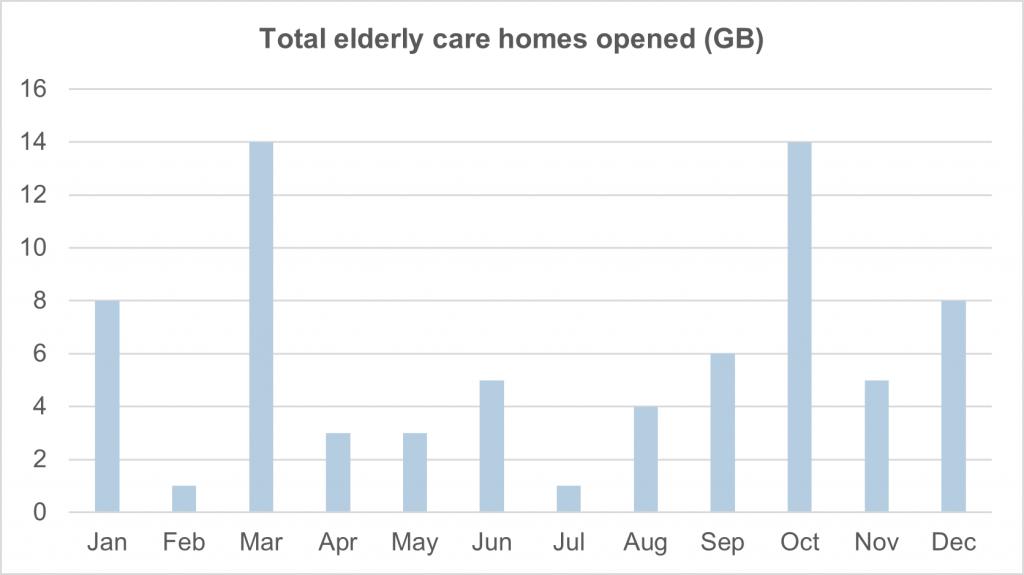

Signs of recovery seen in Q4 following a reduction in openings in Q2 and Q3 2020

As can be seen from the 2020 graph below, elderly care home openings reduced by 52% from 23 in Q1, to just 11 in both Q2 and Q3, before rebounding to 27 in Q4.

Figure 2. Elderly care home openings (2020), Great Britain

We know from our daily conversations with operators that some chose to delay home openings between March and June 2020, primarily due to concerns about being able to admit new residents and having to operate homes with just a handful of residents for months on end. The high-profile and often unfair negative press coverage that the sector endured over those first few months of the pandemic will undoubtedly have fuelled this caution. Similarly, many operators were forced to prioritise firefighting across their portfolios ahead of their expansion plans.

However, there were some exceptions where operators were able to offer discharge pathways from hospitals and took potentially positive residents and were therefore able to fill up new homes quickly. Some elderly care homes also opened as specialist COVID-19 reablement centres.

As the year progressed, it’s clear that confidence returned to the sector, with Q4 opening volumes exceeding those of Q1. It’s likely that having steadied the ship at an organisational level, and with a more appealing (if still challenging) private-pay referral climate, operators felt ready to push the button on the openings that had stalled earlier in the year. December is typically a very slow month for openings – due to seasonal challenges with attracting staff and residents – so 2020’s December figure clearly shows some pent-up opening activity being unlocked.

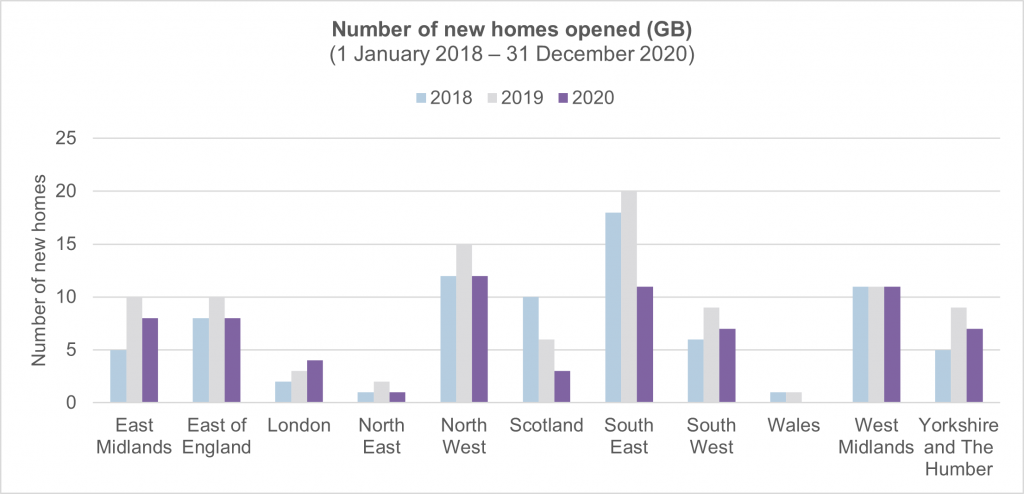

Regional shift in popularity: South East faces competition from North West and the West Midlands

Analysis of this data at a country/regional level over time reveals some interesting shifts in the areas of focus for investors in the sector.

Figure 3. Elderly care home openings by region (2018-2020), Great Britain

For a long time, the South East of England has been the centre of investment, but in 2020 both the North West (12) and the West Midlands (11) were home to the same number of elderly care home openings or more as the South East (11), and each had a higher number of new beds. We are currently working with a number of clients in the North West and West Midlands, and expect both these areas to remain strong in 2021 and 2022.

A potential explanation for the more pronounced drop-off in new openings in the South East in 2020 is that the funding mix in this region tends to comprise a higher proportion of private pay than other areas, and it was this funding stream that was most impacted by the COVID-19 pandemic as referrals dried up over the spring and summer.

Wales has always been an area of lower development activity and this didn’t change between 2018 (1 new home), 2019 (1), and 2020 (0). Scotland, however, experienced a sustained reduction in new home openings across this period – from 10 in 2018, to 6 in 2019, and just 3 in 2020. The decrease in 2020 could be driven by the effect of COVID-19 on private pay referrals, as experienced in the South East of England. The overall trend though is perhaps representative of the fact that there simply aren’t many operators that have a strong focus on Scotland.

Looking to the future

The elderly care home sector has weathered wave after wave of challenges over the past 12 months, but the rollout of the vaccination programme across Great Britain has enabled a measure of confidence to return, with many operators reporting occupancy moving back in the right direction, towards pre-pandemic levels.

The recovery process will take time, but as a business, Carterwood have been reassured by a significant increase in new developer and investor entrants from outside the sector over the last 12 months, in spite of the challenging conditions created by the pandemic. We believe that the additional activity/developments being driven by these organisations, combined by the renewed efforts of established operators to expand their portfolios, will see a return to pre-pandemic opening levels in 2021. The underlying shortfall of market-standard accommodation in the sector remains an appealing investment opportunity, and we expect activity to increase beyond historic levels over the coming years.

Spotlighting the UK’s most active operators

Carterwood keep a close watch on exciting new developments in the market by key players and newcomers alike and continuously monitor the market activity of operators and developers within the sector.

We are pleased to recognise the following UK operators as the most active over the last 3 years (01/01/2018 to 31/01/2021), with Care UK dominating the leader board by opening nearly double the number of homes and beds as the next highest-ranking operator.

Top 20 operators by bed openings within new homes over the past 3 years (01/01/2018 to 31/01/2021)

| Rank | Operator | New beds | New homes |

|---|---|---|---|

| 1 | Care UK Nursing & Residential Care Services | 1,150 | 17 |

| 2 | Barchester Healthcare Ltd | 619 | 9 |

| 3 | Athena Healthcare Group | 507 | 7 |

| 4 | Restful Homes Group | 421 | 5 |

| 5 | Ideal Carehomes Ltd | 396 | 6 |

| 6 | MACC Care Ltd | 394 | 5 |

| 7 | Signature Senior Lifestyle Ltd | 369 | 4 |

| 8 | New Care | 362 | 5 |

| 9 | Cinnamon Care Collection | 358 | 5 |

| 10 | Caring Homes Group | 326 | 5 |

| 11 | Hallmark Care Homes | 319 | 4 |

| 12 | Country Court | 310 | 5 |

| 13 | Bupa Care Homes | 287 | 4 |

| 14 | Runwood Homes Ltd | 284 | 4 |

| 15 | Morar UK | 280 | 4 |

| 16 | Care Concern Group | 268 | 4 |

| 17 | Hamberley Care Homes | 259 | 4 |

| 18 | Porthaven Care Homes | 253 | 4 |

| 19 | Greensleeves Care | 247 | 4 |

| 20 | Gracewell Healthcare Ltd | 231 | 3 |

New care home openings since the Covid-19 pandemic

While there were fewer care home openings overall in 2020 to previous years, it is important to recognise those operators who have overcome the not insignificant challenges of opening new elderly care homes in a pandemic.

Top 10 operators by number of bed openings within new homes since lockdown 1 of the Covid-19 pandemic (23/3/20 to 31/01/21)

| Rank | Operator | New beds | New homes |

|---|---|---|---|

| 1 | Barchester Healthcare Ltd | 285 | 4 |

| 2 | Restful Homes Group | 256 | 3 |

| 3 | Athena Healthcare Group | 213 | 3 |

| 4 | Care UK Nursing & Residential Care Services | 207 | 3 |

| 5 | Ideal Carehomes Ltd | 198 | 3 |

| 6 | Crown Care | 147 | 2 |

| 7 | New Care | 139 | 2 |

| 8 | Hamberley Care Homes | 129 | 2 |

| 9 | Cinnamon Care Collection | 121 | 2 |

| 10 | Morar UK | 117 | 2 |

Future care home openings

It is reassuring to see signs of recovery across the sector, with both large and small operators set to open new homes over the next 12 months. As the sector continues to recover from the impacts of the pandemic, with bed occupancy expected to return to pre-pandemic levels by summer 2022, we expect to see this number increase as operators firm up their opening plans for the upcoming year.

We will continue to monitor the level to which new homes and beds are introduced into the market and predict that those operators who have established teams and processes in place are best positioned to take advantage of any boom development going into 2022.

You can contact Tom Hartley to discuss Carterwood’s research on tom.hartley@carterwood.co.uk or 07715 495062. Find out more about Carterwood’s services and software here.