Last year, we launched our inaugural Carterwood Market Movers research, in which we celebrated those who are investing time, money and effort into bringing much-needed new supply to the older people’s housing sector.

The need for increased accommodation that can support the needs of our growing population of older people remains pressing, so this year we’ve returned to the planning data and updated our research for the period 1 January 2021 to 31 December 2021.

We’re pleased to now be able to reveal Carterwood’s Market Movers 2022.

Market context

The need to increase provision of specialist housing for older people is clear. By 2040, one in four people in the UK will be over-65, with that segment of our population having grown by 41% in 20 years, to nearly 18m people. This is an enormous elderly demographic, with a wide range of accommodation and care needs.

A better choice of accommodation can help older people to live independently for longer, be better integrated with their communities, reduce health and social care costs, and free up much-needed housing stock for younger people.

Despite these clear benefits, development of older people’s housing – and in particular – housing with care or integrated retirement communities (IRCs) has for a long time been limited by a lack of clear government policy, alongside inconsistent decision-making at the local authority planning level. This policy issue is now beginning to be addressed, thanks to the success of organisations like ARCO in bringing together key stakeholders across government and the sector, which has recently resulted in the announcement of a task force on housing for older people.

We believe that the establishment of a task force will create the policy framework required for the sector to grow rapidly over the coming years.

Our latest Market Movers research celebrates those who are forming the vanguard of the sector – the organisations who have committed their resources to bridging the gap in the need for older people’s housing (from sheltered housing to IRCs). These developers and operators have stuck to their guns during 2021, securing consents and bringing new applications into the planning system up and down the UK. They have weathered the storm of COVID-19 and are now perfectly poised to capitalise on the accelerated growth the sector is predicted to experience over the coming years.

Quick links:

- Our approach

- Meet our older people’s housing Market Movers 2022

- The top Market Movers 2022

- Market Movers 2022: What’s moved?

- A spotlight on integrated retirement communities

- Request our latest housing with care planning research

- Market Movers 2020/21 – older people’s housing

- Market Movers 2022 – elderly care home sector

- Methodology

Our approach

Ultimately, our Market Movers research ranks developers and operators by planning activity in the elderly care home, older people’s housing and integrated retirement community sectors over the most recent full calendar year. So, our Market Movers 2022 release covers planning activity over the 12-month period of 1 January 2021 to 31 December 2021.to

For a full breakdown of our methodology, skip to the methodology section at the bottom of this article.

Meet the older people’s housing Market Movers 2022

When it comes to ranking our Market Movers, we have chosen to adopt two approaches.

- As per our Market Movers 2020-21 release, we have ranked our older people’s housing Market Movers by the number of units included in the planning applications that met our criteria. This enables us to identify those who are bringing the greatest new supply to the sector, given variations in scheme size across the sector. For shortlisting purposes, we have only included organisations with more than 100 units represented across their applications.

- We have also ranked our older people’s housing Market Movers by the number of new build applications that met our criteria, which enables us to identify those are investing significant time, energy, and capital to bringing entirely new schemes to the sector. For shortlisting purposes, we have only included organisations with more than 1 older people’s housing application.

Table 1: Market Movers 2022– older people’s housing sector ranked by new build scheme applications

Table 2: Market Movers 2022 – older people’s housing sector ranked by number of units

*Average size only relates to new schemes; extensions are excluded from this datapoint, but are included in the total units number

Carterwood would like to congratulate all our Market Movers 2022 for their continued growth plans throughout 2021, a period undoubtedly impeded by the effects of the pandemic.

However, we can see that four organisations have trumped the leader board, accounting for 30.3% of all planning activity during the period; McCarthy Stone, Churchill Retirement Living, Inspired Villages and Guild Living. Whilst McCarthy Stone and Churchill Retirement Living maintain their first and second positions across both sets of rankings, Inspired Villages snap up third place when ranking by number of new build applications, while Guild Living seize third place when ranking by number of units.

This line up is it not too dissimilar to our Market Movers 2020-21 release, with McCarthy Stone continuing to rank first, and with Audley Retirement and Retirement Villages Ltd also returning to the top 10.

However, we also welcome a number of new organisations to our Market Movers list, reflecting the diversity within retirement living housing development. These include retirement housing specialists such as Anchor, Adlington Retirement Living, Beechcroft Developments Ltd, Enterprise Retirement Living Ltd, Gladman Retirement Living Ltd, Highwood Group, LifeCare Residences Limited and Housing & Care 21, alongside more generalist developers and a selection of site-specific organisations, who all make the top 20.

“We often don’t appreciate just how challenging it can be to acquire and get planning permission for even one multi-million-pound scheme. Land acquisition and planning are very complex processes that require a lot of skill from experienced teams to successfully navigate. Some of our Market Movers are delivering more than five consented schemes consistently each year and I am immensely proud to work with many of these organisations – each of whom are driving the growth of the elderly care home and retirement living sectors to meet the current and future demands of our elderly communities.”

Tom Hartley, managing director at Carterwood

The top Market Movers 2022

We caught up with our top older people’s housing Market Movers to get their thoughts on the state of the market, what strategic investment plans are on the horizon and their ambitions for the future of retirement living housing.

Spotlight on our #1 Market Mover 2022: McCarthy Stone

“We are seeing exceptionally strong demand among older consumers for our products and services, and with the positive way our industry responded to Covid-19 we are really confident about the future. We are looking to invest in at least 60 new sites each year and grow again quickly. Retirement communities bring life back to high streets, help older people feel happier, healthier and more independent, and also unlock the wider housing market to help first time buyers. We look forward to continuing to make a positive difference to society and the lives of even more older people in future.”

John Tonkiss, chief executive at McCarthy Stone

Spotlight on our #2 Market Mover 2022: Churchill Retirement Living

“Churchill has ambitious plans for the future with our Growth Drive ’25 initiative, a strategy to deliver over 1,000-unit sales in a single year by 2025. To achieve this, we are looking to invest £800m in new sites over the coming years, and we have recently opened new offices in Warrington and Bristol to support our growth plans. Given the huge benefits retirement housing can generate for individuals and their families, building more of this type of housing will play a key part in our country’s future. Our growth plans will help to realise more of these benefits, enabling many older people to live happier, healthier, more independent lives. By doing this we can also create new jobs, regenerate local high streets, and deliver new communities that give an economic boost to towns and cities across the country.”

Spencer J McCarthy, chairman & CEO at Churchill Retirement Living

Spotlight on our #3 Market Mover 2022 (by number of new build schemes): Inspired Villages Group

“Inspired Villages has been able to continue adding to our development pipeline and securing planning consents for new integrated retirement communities across the UK. In 2022, we’ll go even further with the acquisition of more sites and the submission of our highest number of planning applications as we work to deliver a significant number of sites as part of our ambitious plans through our joint venture with Legal & General and NatWest Group Pension Fund.”

Stuart Garnett, land & planning director at Inspired Villages

Market Movers 2022: What’s moved?

Top Market Mover planning activity on the up

So then, what’s changed since our Market Movers 2020-21 release?

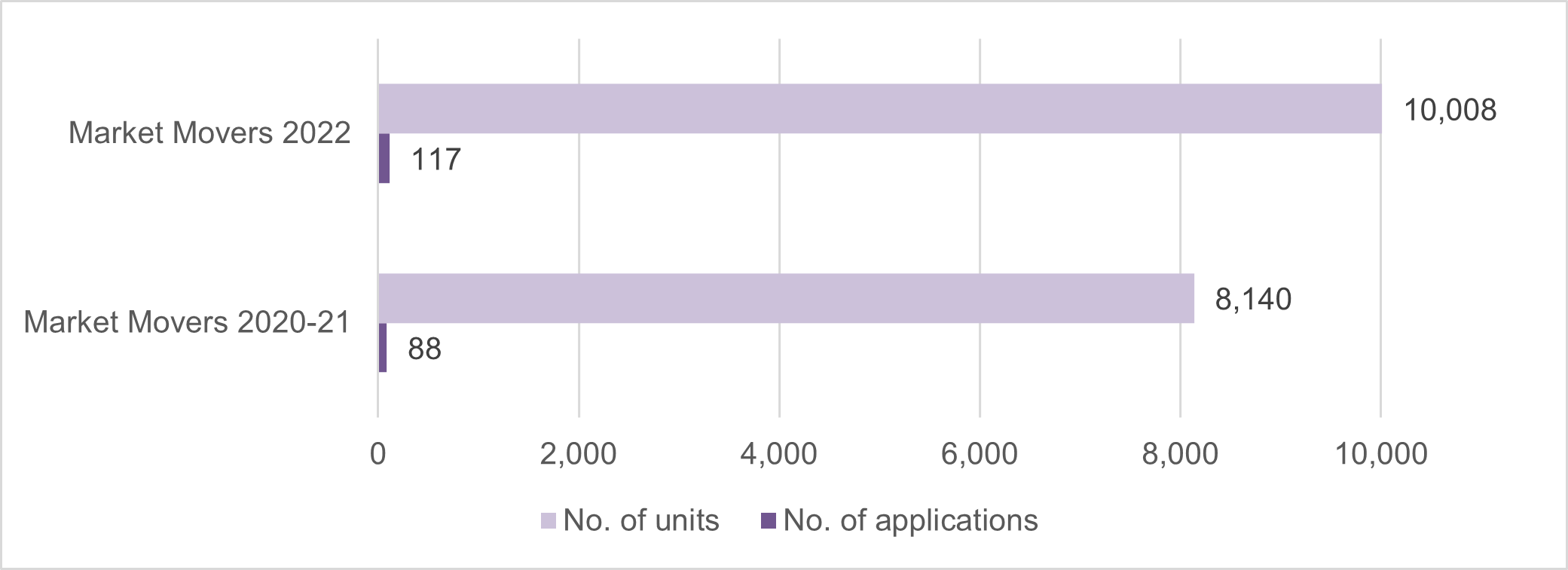

Our Market Movers 2020-21 release tracked the planning activity from April 2020 to April 2021 (12 months following the initial outbreak of the pandemic in the UK). Since then, the sector has continued its recovery, and our Market Movers 2022 release shows a clear increase in the number of both applications and units being applied for.

Let’s take the top 20 Market Movers as an example. When analysing their planning activity across both the 2020-21 and 2022 releases (ranked by units to ensure comparable datasets), there has been a 33% increase in the number of applications, and a 22.9% increase in the number of units within those applications.

Figure 1: Number of units and applications made by Top 20 Market Movers 2022 vs Top 20 Market Movers 2020-21 (ranked by units)

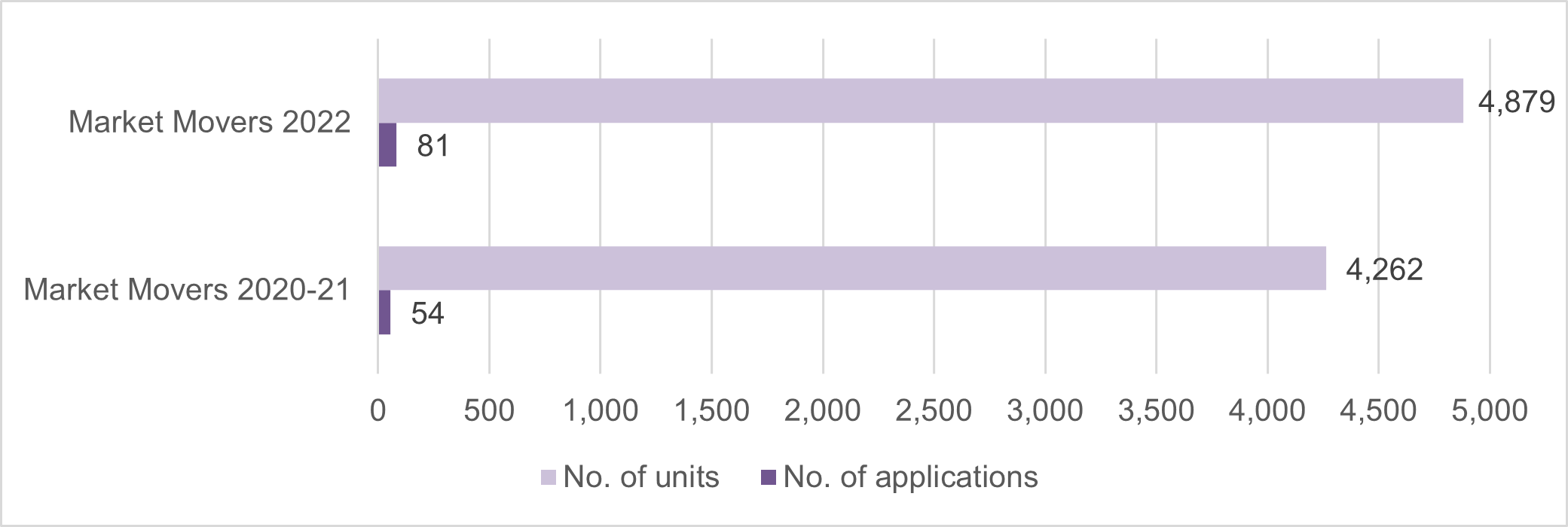

Taking a closer look, we can also reveal that the vast majority of this planning activity is being driven by the top 3 Market Movers, who have shown a 50% increase in the number of applications and a 14.5% increase in the number of units being applied for since the Market Movers 2020-21 release.

Figure 2: Number of units and applications made by Top 3 Market Movers 2022 vs Top 3 Market Movers 2020-21 (ranked by units)

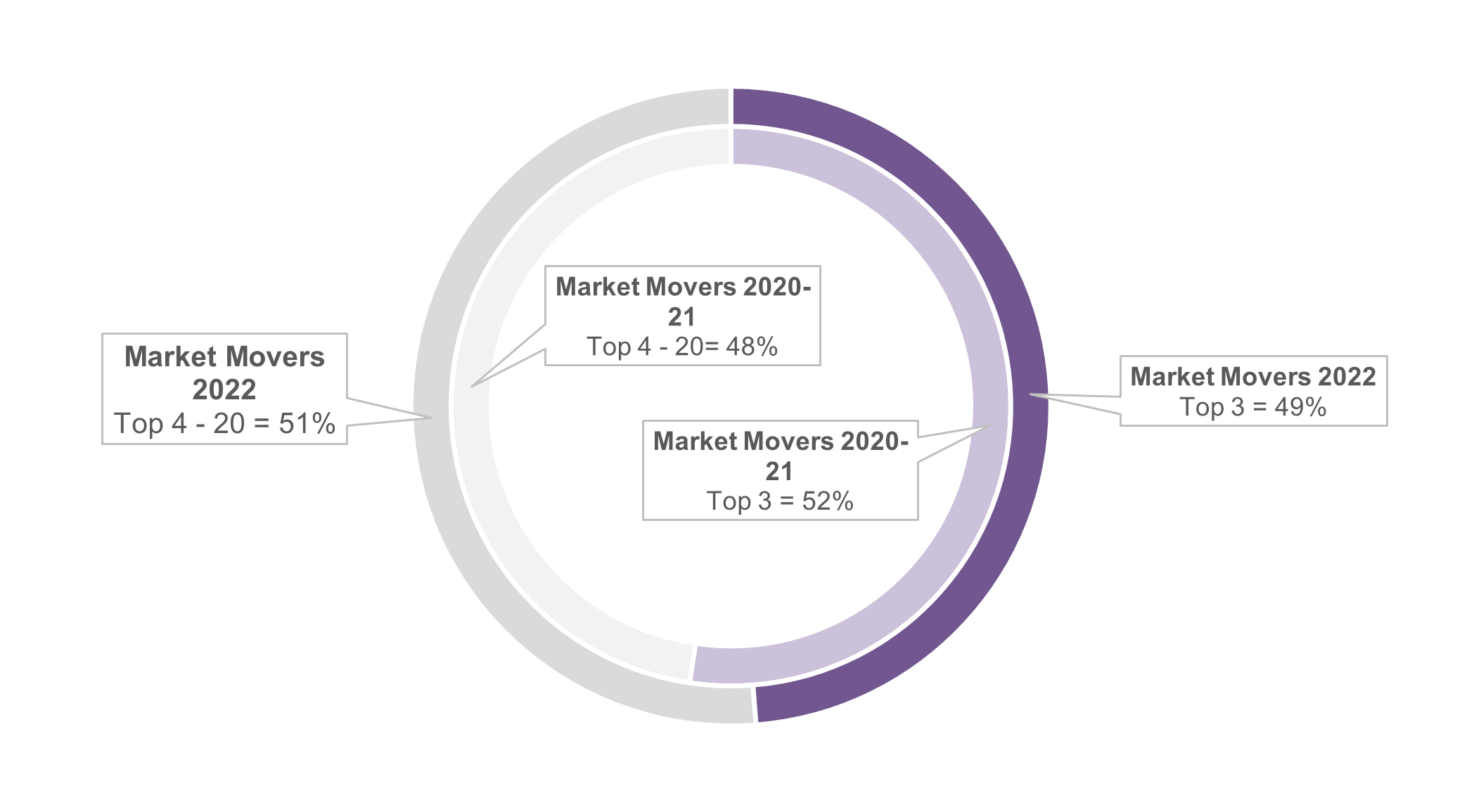

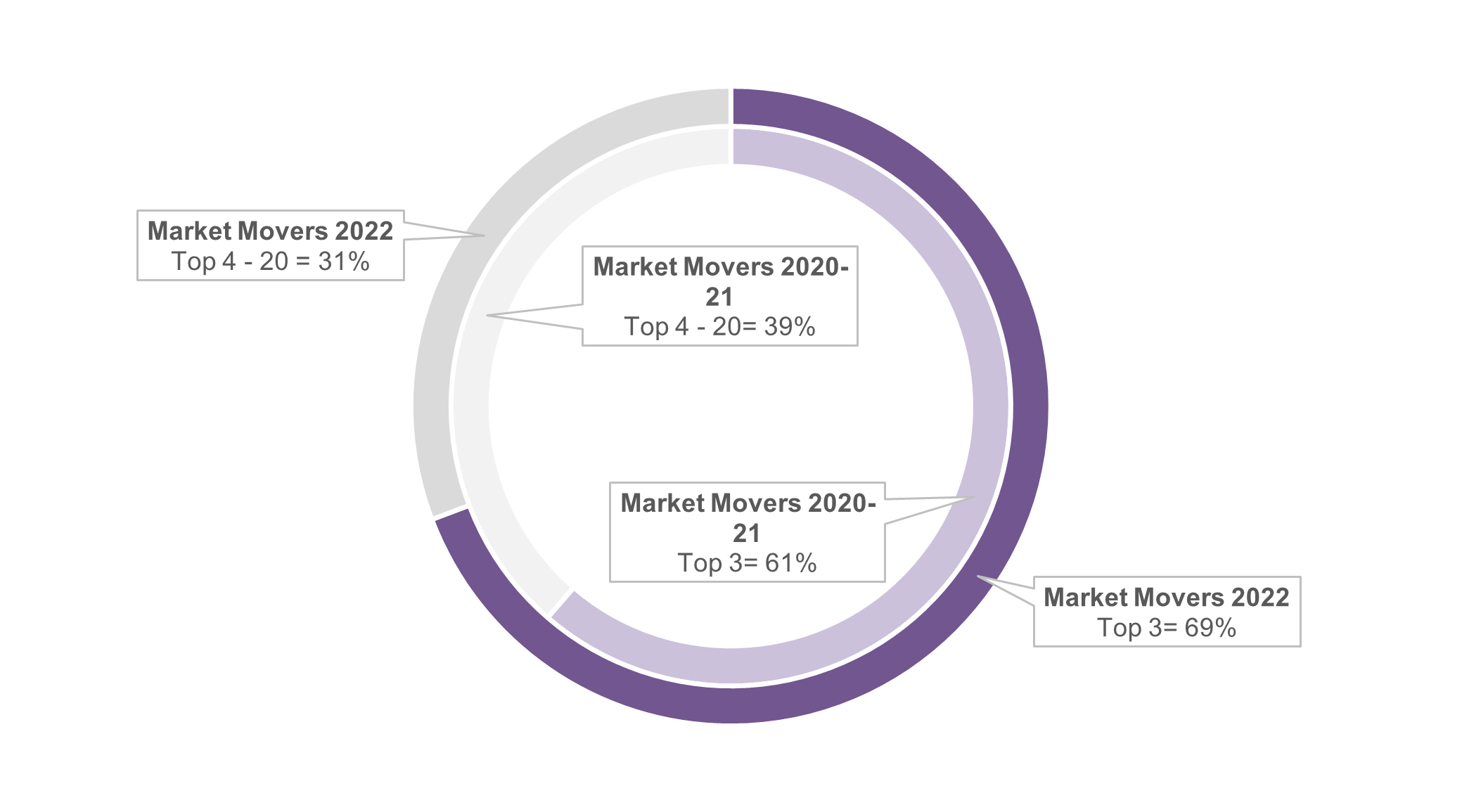

This imbalance of planning activity across the top 20 Market Movers 2022 is acute, with 49% of all top 20 units and 69% of all top 20 applications being made by the top 3 Market Movers. This trend is not too dissimilar to the Market Movers 2020-21 release, where the top 3 Market Movers dominated planning activity. However, for our Market Movers 2022 release, we see that although the proportion of top 20 applications made by the top 3 Market Movers has grown (by 8%), the proportion of top 20 units made up by the top 3 Market Movers has decreased marginally (by 3%).

Figure 3: Market Movers 2022 and 2020–21: Number of units by top 3 vs. top 4–20 Market Movers

Figure 4: Market Movers 2022 and 2020–21: Number of applications by top 3 vs. top 4–20 Market Movers

This increase in planning activity is undoubtedly a result of the strength and resilience of the retirement housing sector, which is now showing signs of recovery following the pandemic, with a healthy number of developments in the planning pipeline.

Despite the increases in planning activity, it seems as though the average size of planned scheme across the top 20 Market Movers remains constant at circa 150 units, with scheme size ranging from 47 for smaller retirement housing schemes to 257 for larger retirement village complexes. That being said, the average scheme size of the top 3 Market Movers 2022 is significantly smaller than this at 119 units, which is somewhat distorted by Guild Living’s much larger average scheme size. When we look at the top 3 Market Movers 2022 by number of new build applications, the average scheme size is even smaller at 69 units.

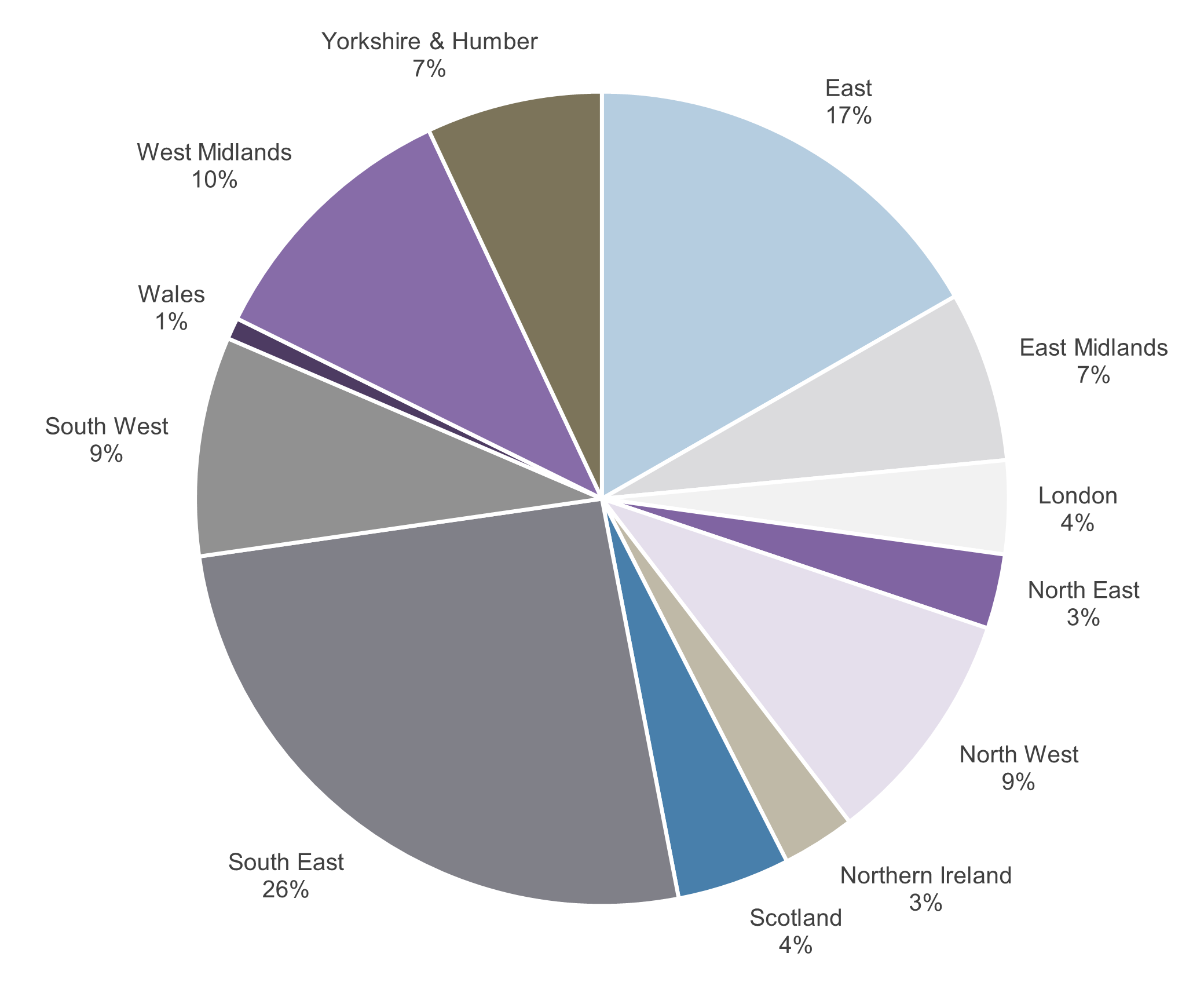

Figure 5: Planned older people’s housing units – by country/region

From the chart above, it’s clear where our Market Movers 2022 have been focusing over 2021. Once again, the South East is the leading region for planned new units with just over a quarter of new planned units, with high house prices underpinning the business case for the development of new schemes in the region. The second most popular region, with 17% of new planned units, is the East of England – another historically popular region for development.

When comparing this to our Market Movers 2020-21 release, the dominance of these two regions remains largely unchanged. However, it is interesting to see the that the South East has seen a 15% decrease in planning activity in favour of developing more widely across the UK. The East Midlands, London, North East, North West, West Midlands and Yorkshire & Humber have all seen increased planning activity, whilst previous non-players such as Northern Ireland, Scotland and Wales are now beginning to make their mark on the map.

We will watch with interest to see how these planning applications progress through the planning system; however, if you would like to find out more about planning trends in the housing with care sector – look no further!

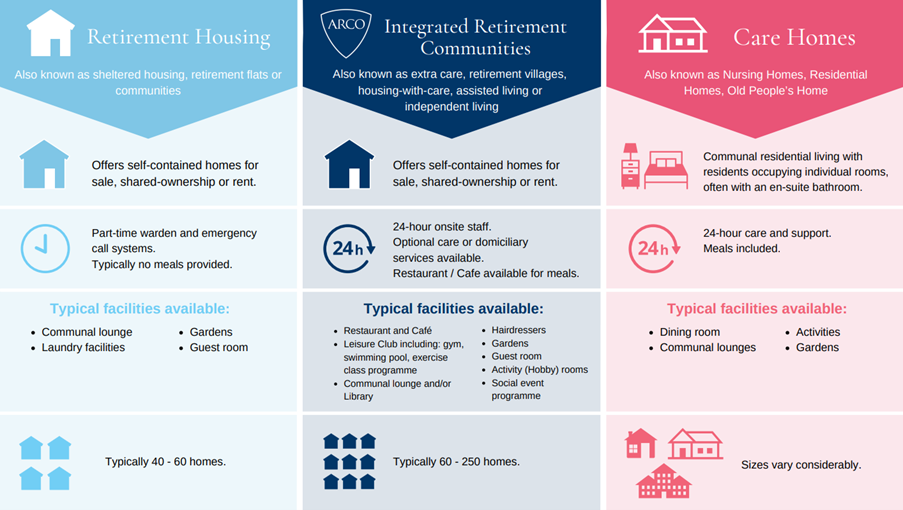

A spotlight on Integrated Retirement Communities

This year, in addition to recognising those Market Movers in the elderly care home and wider and older people’s housing sectors, we also want to celebrate those that are making waves in the integrated retirement community sector; the new term for the housing-with-care sector represented by ARCO.

“Carterwood’s new Market Movers report demonstrates the wide range of operators doing great work to plan and build integrated retirement communities to improve choice for older people across the country.

“But it also highlights that building integrated retirement communities – and responding to the needs and aspirations of older people – remains unnecessarily complex compared to care homes and traditional retirement housing. A clear definition to remove the lack of clarity around the integrated retirement community model is imperative.

“Our sector is poised for huge growth, but if it is to realise its full potential, we need to see planning reform so that housing-with-care options are much easier and quicker to build, and so, ultimately, we can meet the needs of our ageing population.

“The new Older People’s Housing Taskforce announced by the Government will be a crucial vehicle through which to achieve this transformation.”

Michael Voges, executive director of ARCO

For too long, consumers, policymakers, investors and the wider public have been confused by the sheer number of terms used to describe the ‘housing with care’ sector. This new term aims to unite these, allowing law and practice and Government to use one common term to describe what ARCO members do.

Unlike some retirement housing schemes, integrated retirement communities combine high quality housing options for older people with tailored support services. They allow residents to rent or own a property and to maintain their privacy and independence, with the reassurance of 24-hour on-site staff, communal facilities, and optional care and support as needed.

Image source: ARCO

To find out more about integrated retirement communities, please visit the ARCO website.

As it stands, there is much ambiguity in the planning system, which currently does not have a designated class for such integrated retirement community developments.

In today’s planning system, it is unlikely (but not impossible) that a retirement housing scheme (rather than an integrated retirement community/ housing with care scheme) would be classified as C2, in the same way that not all integrated retirement community schemes are classed as C2. Similarly, any ARCO approved scheme would naturally be an integrated retirement community; however, many integrated retirement communities are not ARCO members.

Clarity in the planning system is a key issue that the ARCO Housing with Care Task Force is looking to address. Until there is clear definition and categorisation of housing-with-care, we are simply unable to capture and rank all integrated retirement community planning activity. We can, however, celebrate the planning activity of ARCO members who are leading the way in integrated retirement community development.

Table 3: Planning activity from ARCO members

*Average size only relates to new schemes; extensions are excluded from this datapoint, but are included in the total units number.

Although the integrated retirement community term has been created by ARCO, it is not exclusive to their members, as evidenced by top Market Mover 2022 McCarthy Stone looking to bring a potential 17 new ‘Retirement Living Plus’ schemes (equating to 1,147 units) to market. These schemes fall squarely into the category of integrated retirement community and represent almost half McCarthy Stone’s planning activity in 2021.

We congratulate all the above integrated retirement community developers and operators on their commitment to bringing much needed supply to the older peoples housing sector. In particular, to Inspired Villages, Audley Retirement, Anchor Hanover and Retirement Villages Ltd, who all achieved top 10 positions in our older people’s housing Market Movers 2022.

Together, these companies have driven nearly 3,000 units into the planning system over the course of 2021, a figure that we expect to grow over the coming years with the implementation of the Older People’s Housing Taskforce, paving the way for ARCO’s vision of having 250,000 people living in integrated retirement communities by 2030.

This sector has played, and will continue to play, a significant role in the future of older people’s housing and we are proud to recognise the integrated retirement community sector in our Market Movers 2022 research.

Request our latest planning research report for free

Explore how the planning pipeline for new-build housing with care schemes has changed over the last 5 years as we assess…

- How volumes of applications have changed

- The degree to which decision favourability has shifted

- Whether decisions are being returned slower

- Changes in average scheme size being applied for

Please click here to request your copy of our latest housing with care planning research

Fancy a reminder of our Market Movers 2020–21?

For a refresh of who made the shortlist last year, simply click here.

Tempted to take a look at the Market Movers 2022 in the elderly care home sector?

It’s not just the older people’s housing sector that gets its own Market Movers research, we also identify and celebrate the movers and shakers in the elderly care home sector.

Click here to explore our elderly care home Market Movers 2022 release

Methodology – What makes a Market Mover?

Our Market Movers 2022 research ranks developers and operators by planning activity in the elderly care home, older people’s housing and integrated retirement community sectors over the 12-month period of 1 January 2021 to 31 December 2021.

For a planning application to qualify for inclusion in this edition of the Carterwood Market Movers, it had to have been validated in the United Kingdom and:

- Have been granted permission during the period 1 January 2021 to 31 December 2021 (please note: this includes applications validated prior to this period, but granted during it)

OR

- Have been validated during the period 1 January 2021 to 31 December 2021, and still be pending a decision (please note: this includes pending appeals, but does not include refused applications with no appeals).

Other factors:

- Planning applications for both new schemes and extensions are included in the figures when ranking by number of units but planning applications for extensions are excluded when ranking by number of new build applications.

- An older people’s housing planning application is defined as: any applications for new units of older people’s housing, covering housing with and without care (falling in both C2 and C3 uses), including everything from age exclusive/sheltered housing to extra care/close care.

- An integrated retirement community planning application is defined as: any applications for new units of older people’s housing with care (falling in both C2 and C3 uses), submitted by an ARCO registered integrated retirement community

Time period

For our Market Movers 2022 release we have used the 12-month period from 1 January 2021, which represents the first full calendar year since the outbreak of the COVID-19 pandemic.

This differs to our first Market Movers release, where we assessed the 12-month period from 1 April 2020 in order to assess a period that was entirely affected by the COVID-19 pandemic, instead of using the whole of 2020 (which would have 2–3 months of ‘normal’ business and 9-10 months of very different circumstances). This does mean there is somewhat of an overlap between the data in this release and our 2020–21 release; however, for future releases of Market Movers, we aim to continue to use full calendar years.

Data sources

The data used to generate the Market Movers lists is sourced from Glenigan, Planning Pipe, and local authority planning websites, then vetted and checked by our expert data team. To ensure the accuracy of this research, we have reached out to developers and operators by email, asking for information on planning applications during the period in question.

Exclusion notes

McCarthy Stone have been excluded from the elderly care home rankings as their applications that include care home beds are part of a mixed-use application where McCarthy Stone are developing the older people’s housing element, and are not involved in the care home element. Likewise, Barchester have been excluded from the older people’s housing rankings list as their applications that include older people’s housing units are part of a mixed-use application where Barchester are developing the care home element, and are not involved in the older people’s housing element.

100% accuracy is difficult to achieve, but our sector-specialist team has worked extremely hard to ensure this research is as accurate as it can be. That being said, please let us know via info@carterwood.co.uk if you think there’s anything that’s not quite right.