Last year, we launched our inaugural Carterwood Market Movers research, in which we celebrated those who are investing time, money and effort into bringing much-needed new supply to the elderly care home sector.

The goal of ensuring our growing elderly population has sufficient fit-for-purpose accommodation to support their care needs in the coming years is not a temporary issue, so this year we’ve returned to the planning data and updated our research for the period 1 January 2021 to 31 December 2021.

We’re pleased to now be able to reveal Carterwood’s Market Movers 2022.

Market context

The elderly care home market in Great Britain currently has a shortfall of 45,000 en-suite (WC and hand-basin at a minimum) bedrooms, a number that we believe will grow to 58,000 by 2025.

This shortfall is being driven by an increase in demand – the proportion of our population that’s 85+ years old is predicted to increase from 2.58% in 2022 to 2.71% in 2025 – which is not sufficiently offset by the steady but slow increase in supply of elderly care home beds. Since 2012 en-suite provision in elderly care homes has risen from 62% of all beds to 73%, as new homes with en-suite bedrooms have been brought to market and older homes (that would typically not be en-suite) have closed.

There clearly remains a need for new, modern, elderly care home accommodation. Our Market Movers research identifies the organisations that are driving the sector forward towards meeting that need, but before we go any further, it’s essential to first acknowledge the circumstances that shaped the period under review – 2021.

The COVID-19 pandemic has put unprecedented pressures on operators and developers of elderly care homes. The number of mortalities due to COVID-19 in elderly care homes thankfully reduced considerably in 2021, as well-honed infection control practices minimised danger to residents. However, the financial and operational pressures on operators have not abated. Infection control procedures, while essential, are costly, and the staffing crisis affecting the sector has become even more acute. For developers of elderly care homes, supply chain issues have lengthened project times and triggered a dramatic increase in the cost of materials and labour.

It’s against this background that we celebrate those who have invested time, energy, and capital into development plans that will help to futureproof the sector against the evolving needs of its elderly population.

Quick links:

- Our approach

- Meet our elderly care home Market Movers

- The top Market Movers 2022

- Market Movers 2022: What’s moved?

- Request our latest elderly care home planning research

- Market Movers 2020/21

- Market Movers 2022 – older people’s housing sector

- Methodology

Our approach

Ultimately, our Market Movers research ranks developers and operators by planning activity in the elderly care home, older people’s housing and integrated retirement community sectors over the most recent full calendar year. So, our Market Movers 2022 release covers planning activity over the 12-month period of 1 January 2021 to 31 December 2021.to

For a full breakdown of our methodology, skip to the What makes a Market Mover? section at the bottom of this article.

Meet the elderly care home Market Movers 2022

When it comes to ranking our Market Movers, we have chosen to adopt two approaches.

- As per our first Market Movers release, we have ranked our elderly care home Market Movers by the number of beds included in the planning applications that met our criteria, which enables us to identify those developers and operators who are bringing the greatest potential bed capacity to the sector. For shortlisting purposes, we have only included organisations with 100 or more elderly care home beds represented across their applications.

- We have also ranked our elderly care home Market Movers by the number of new build applications that met our criteria, which enables us to identify those that are investing significant time, energy, and capital to bringing entirely new homes to the sector. For shortlisting purposes, we have only included organisations with more than 1 elderly care home application.

Market Movers – elderly care home sector

Table 1: Elderly care home sector Market Movers ranked by new build applications

Table 2: Elderly care home sector Market Movers ranked by number of beds

*Average size only relates to new homes; extensions are excluded from this datapoint, but are included in the total new beds number

Carterwood would like to congratulate all the elderly care home Market Movers for their commitment to growth, as evidenced in their planning activity in 2021, especially in a sector that has been, and continues to be, acutely affected by the impacts of the pandemic.

We’d particularly like to applaud the three organisations who have spearheaded planning activity across the sector in 2021, LNT Group, Frontier Estates Ltd and Barchester Healthcare Ltd, who feature as front runners in both sets of rankings. Together, these three Market Movers have validated an impressive 71 planning applications for 4,589 beds over the course of 2021, accounting for 17.8% of all planning activity during the period.

Once again, it is great to see such a diverse range of organisations represented in the planning pipeline. We are pleased to see many operators and developers return to our Market Movers for 2021, including Simply UK, Care UK, Montpelier Estates, New Care and Liberty Care Developments Ltd, Tanglewood Care Services Ltd, Care Concern, Hamberley Development, Avery Healthcare Group and Yorkare Homes Ltd, who all rank in our top 20, with many making significant rank improvements since our Market Movers 2021 release.

We also welcome those organisations who are new entrants to our Market Movers research, but by no means new to the sector, including Hallmark Care Homes, Aspire LPP, Burlington Care, Anavo Care, Signature Senior Lifestyle Ltd and Connaught Care, whose increased planning activity over 2021 has earned them top 20 places.

“We often don’t appreciate just how challenging it can be to acquire and get planning permission for even one multi-million-pound scheme. Land acquisition and planning are very complex processes that require a lot of skill from experienced teams to successfully navigate. Some of our Market Movers are delivering more than five consented schemes consistently each year and I am immensely proud to work with many of these organisations – each of whom are driving the growth of the elderly care home and retirement living sectors to meet the current and future demands of our elderly communities.”

Tom Hartley, managing director at Carterwood

The top Market Movers 2022

We caught up with our top three Market Movers to get their thoughts on developments in the market, future planning activity and their ambitions for the future of the care sector.

Spotlight on our #1 Market Mover 2022: LNT Group

“It has been an outstanding effort from all the team, through development, planning and construction to significantly increase the number of high-quality care beds delivered to try and meet the increasing demands of the elderly care market. The strength of our pipeline ensures we can continue to work with operators to meet this growing demand over the coming years.”

Matt Lowe, chief executive at LNT Group

Spotlight on our #2 Market Mover 2022: Frontier Estates Ltd

“This is a really exciting time for care development as the need for better quality care facilities continues to grow and we’re really pleased Frontier continues to be at the heart of this. In the last 10 years we have delivered an unrivalled number of planning consents and bespoke quality care facilities. We would like to thank all of our clients and partners who we’ve worked closely with for their continued support, which allows us to deliver quality, bespoke care schemes that are putting the need of the residents, staff and communities at the forefront. Our team is creating a better future for care and we’re looking forward to continuing to innovate this market.”

Sam Rous, development director – head of healthcare at Frontier Estates Ltd

Spotlight on our #3 Market Mover 2022: Barchester Healthcare Ltd

“Barchester are very proud to be included in such a prestigious list of movers and shakers in the care sector. Barchester have achieved a significant number of planning permissions in the last 18 months, despite the obstacles provided, and have some 2,000 plus beds in our pipeline secured going forward. I am very fortunate to have the full support of the senior management team at Barchester and an exemplary legal team, whose input enables us to complete transactions so expediently. That’s why we regularly secure such a high position in this table.”

Julian Burgess, land buyer at Barchester Healthcare Ltd

Market Movers 2022: What’s moved?

Top Market Mover planning activity on the up

There is something that is clear when comparing the Market Movers 2022, to the Market Movers 2020-21 release, which tracked the planning activity from April 2020 to April 2021 (12 months following the initial outbreak of the pandemic in the UK). Both the number of applications and the number of beds within those applications have increased noticeably.

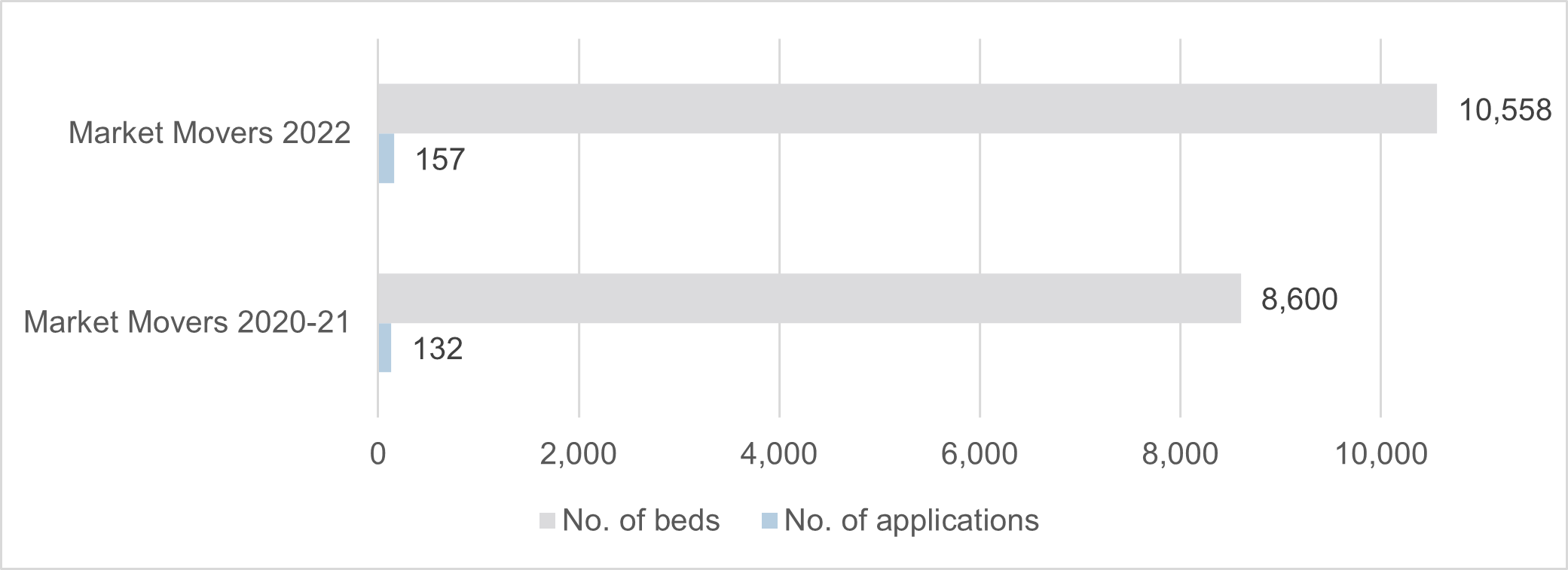

When analysing the planning activity of the top 20 Market Movers across both the 2020-21 and 2022 releases (ranked by beds to ensure comparable datasets), there has been a 18.9% increase in the number of applications, and a 22.8% increase in the number of beds being applied for.

Figure 1: Number of beds and applications made by Top 20 Market Movers 2022 vs Top 20 Market Movers 2020-21 (ranked by beds)

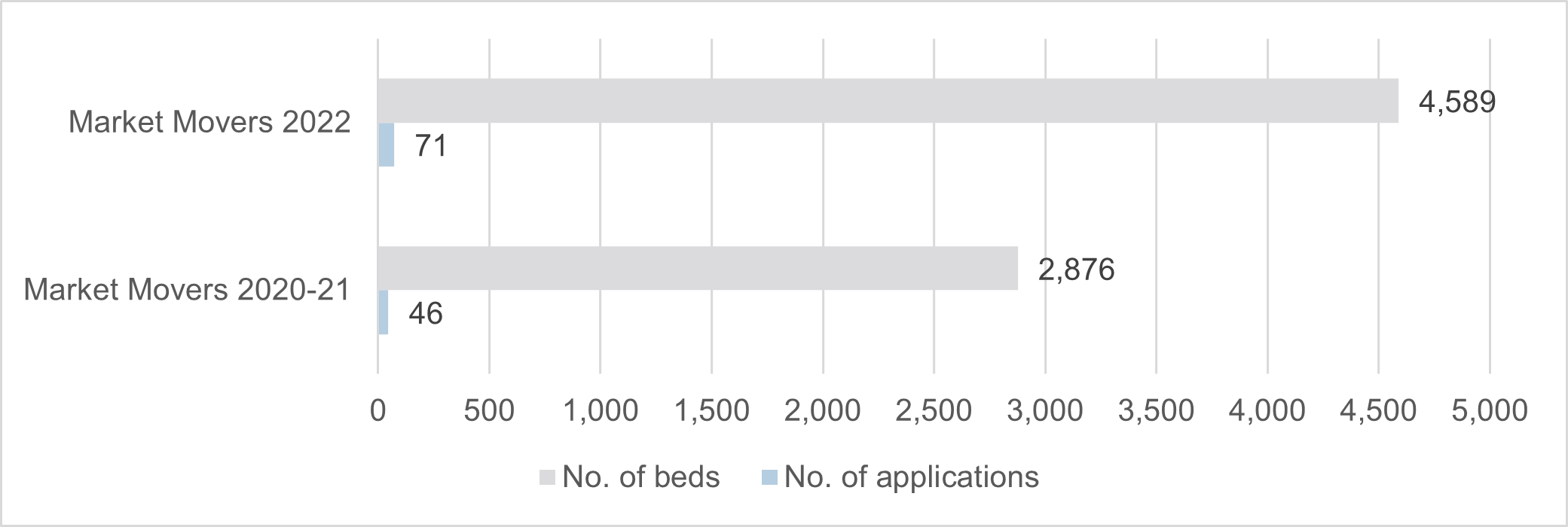

However, when delving deeper, it appears that most of this activity is, perhaps unsurprisingly, coming from the top 3 Market Movers 2022, whose number of applications has increased by 54.3% and the number of beds being applied for by 56.9% when compared with the Market Movers 2020-21 release.

Figure 2: Number of beds and applications made by Top 3 Market Movers 2022 vs Top 3 Market Movers 2020-21 (ranked by beds)

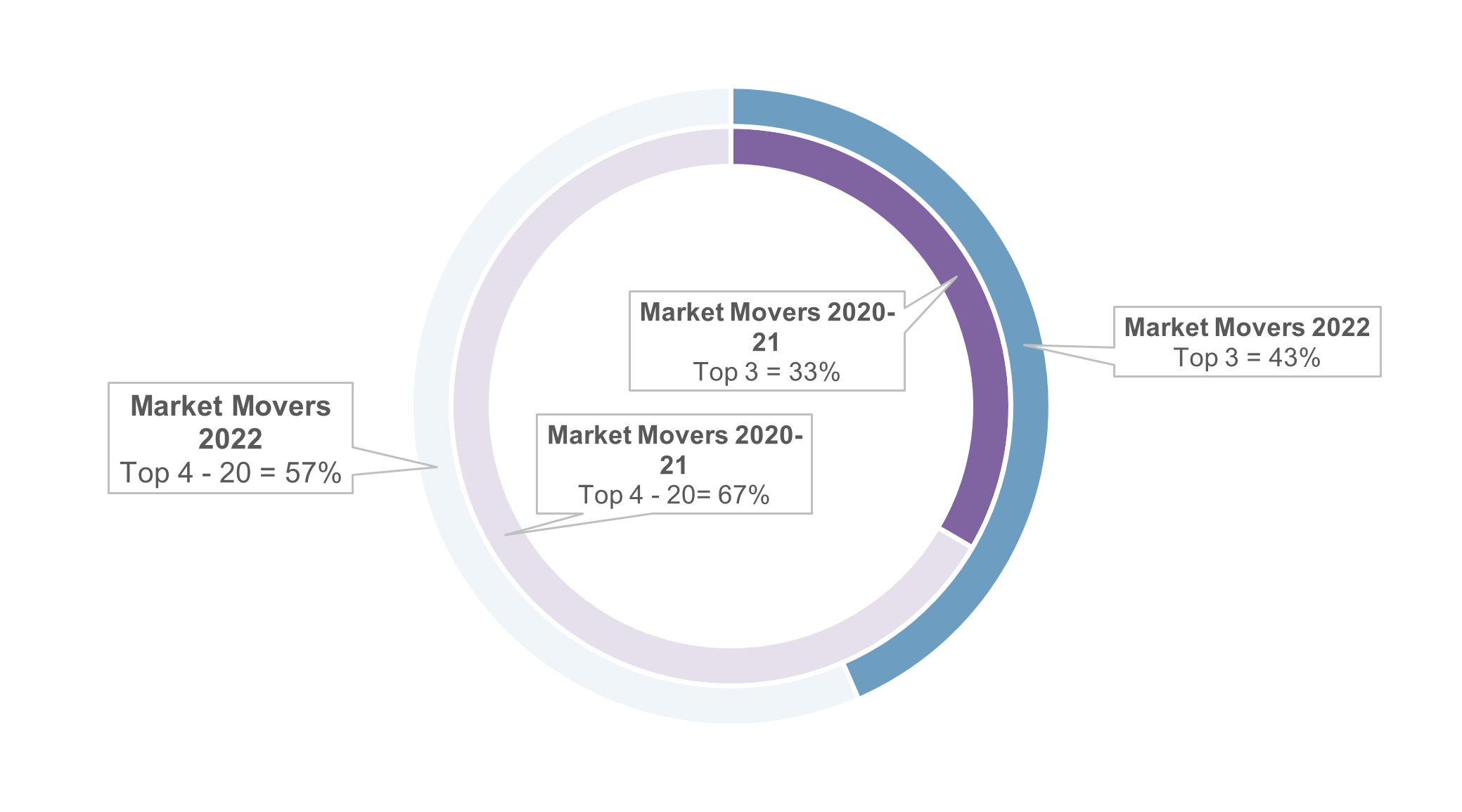

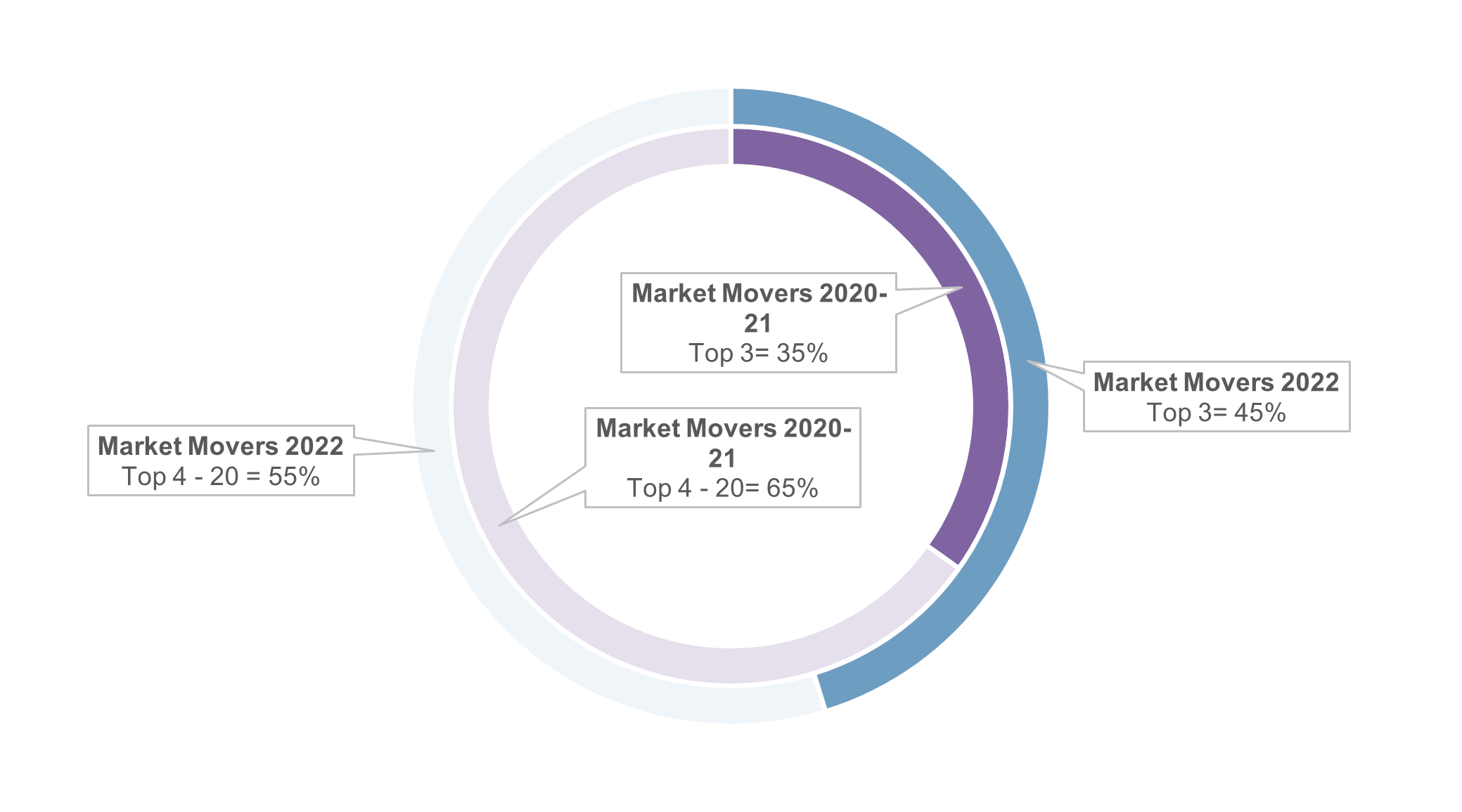

This imbalance of planning activity across the top 20 Market Movers 2022 is acute, with 43% of all top 20 bed applications and 49% of all top 20 applications being made by the top 3. This trend is not too dissimilar to our Market Movers 2020-21 release, where the top 3 Market Movers dominated planning activity. However, for our Market Movers 2022 release, we see that the proportion of planning activity by the top 3 has grown by 10% across both the number of beds and applications.

Figure 3: Market Movers 2022 and 2020-21: Number of beds by top 3 vs. top 4–20 Market Movers

Figure 4: Market Movers 2022 and 2020-21: Number of applications by top 3 vs. top 4–20 Market Movers

This increase in planning activity is undoubtedly a result of the strength and resilience of the care sector, which having been so badly affected by the impact of the pandemic, is now beginning to show signs of recovery, with a healthy number of developments in the planning pipeline.

Interestingly, we can also see a trend in the size of the average planned home, which across the top 20 has decreased from 76 beds in our 2020-21 release to 71 beds in our 2022 release. This reduction appears to be driven by the great volume of application by the top 3 Market Movers, who maintain a lower average size of 65–66 beds across both releases.

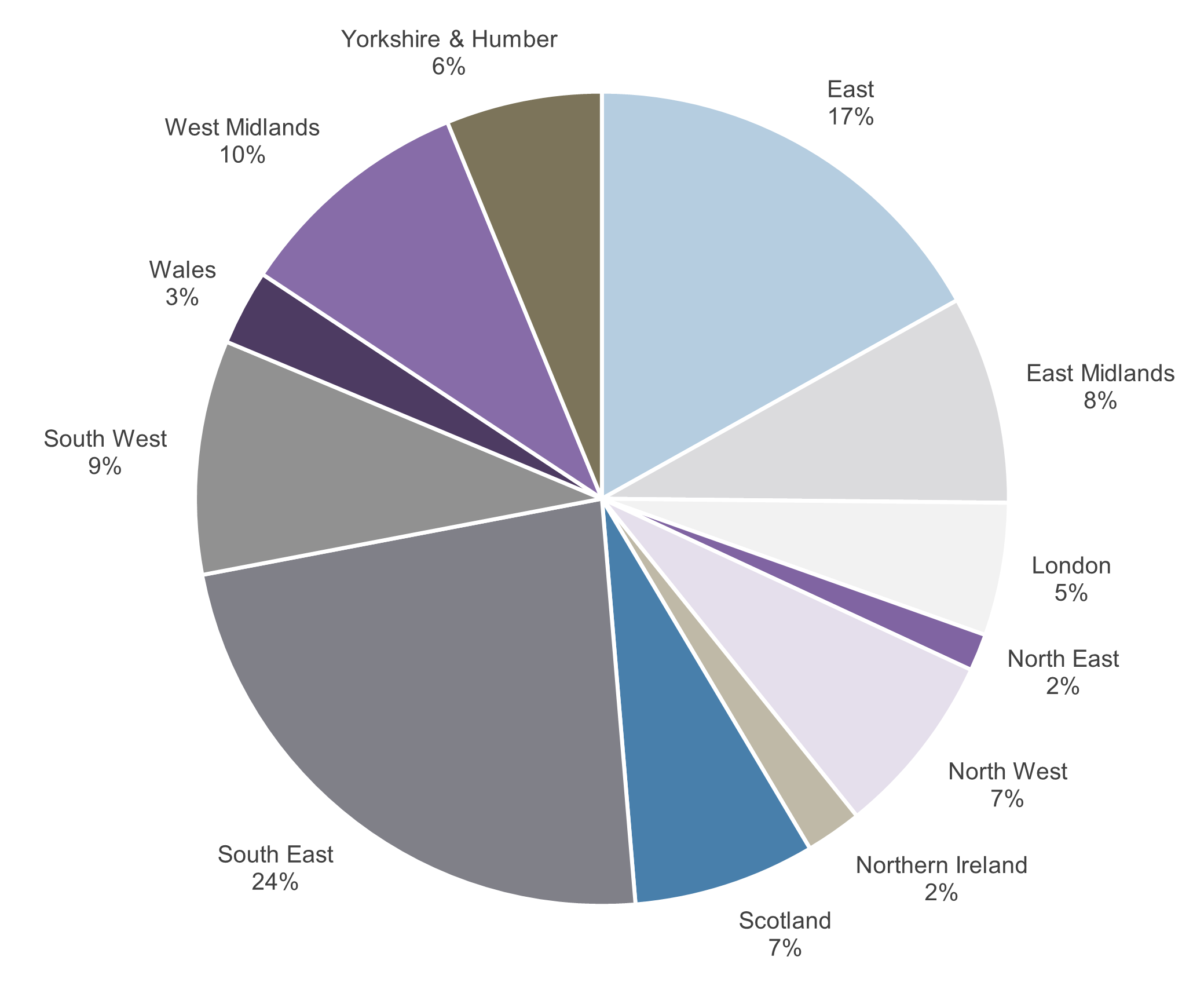

Figure 5: Planned elderly care home beds – by country/region

From the chart above, it’s clear where our Market Movers have been focusing over 2021. Once again, the South East is the leading region for planned new beds, with nearly a quarter of this activity and with high house prices underpinning the business case for the development of new homes in the region. The second most popular region, with 17% of new planned beds, is the East of England – another historically popular region for development.

The popularity of these two regions remains largely unchanged from our Market Movers 2021 release; however, it is interesting to see fluctuations across other regions, with the East Midlands, London, the North East, Scotland and Wales showing an increase in planning activity whilst the North West, the West Midlands and Yorkshire and the Humber show a decrease in activity.

We will watch with interest to see how these planning applications progress through the planning system, however, if you would like to find out more about planning trends in the elderly care home sector – look no further!

Request our latest planning research report for free

Explore how the planning pipeline for new-build elderly care homes has changed over the last 5 years as we assess…

- How volumes of applications have changed

- The degree to which decision favourability has shifted

- Whether decisions are being returned slower

- Changes in average scheme size being applied for

Please click here to request your copy of our latest elderly care home planning research

Fancy a reminder of our Market Movers 2020-21 release?

For a refresh of who made the shortlist in 2021, simply click here.

Tempted to take a look at the Market Movers in the older people’s housing sector?

It’s not just the elderly care home sector that gets its own Market Movers research, we also explore the older people’s housing sector to identify and celebrate the movers and shakers in the retirement living scene, including integrated retirement communities. Click here to explore our older people’s housing Market Movers 2022 release

Methodology

What makes a Market Mover?

Our Market Movers research ranks developers and operators by planning activity in the elderly care home, older people’s housing and integrated retirement community sectors over the most recent full calendar year (see the section below on time period assessed for the exception to this). Our Market Movers 2022 release therefore covers planning activity over the 12-month period of 1 January 2021 to 31 December.

For a planning application to qualify for inclusion in this edition of the Carterwood Market Movers, it had to have been validated in the United Kingdom and:

- Have been granted permission during the period 1 January 2021 to 31 December 2021 (please note: this includes applications validated prior to this period, but granted during it)

OR

- Have been validated during the period 1 January 2021 to 31 December 2021, and still be pending a decision (please note: this includes pending appeals, but does not include refused applications with no appeals).

Other factors:

- Planning applications for both new schemes and extensions are included in the figures when ranking by number of beds, but planning applications for extensions are excluded when ranking by number of new build applications.

- An elderly care home planning application is defined as: any application for additional care home beds for the elderly that will be registered with a regulatory body (CQC, RQIA, SCI and CIW).

Time period assessed

For our Market Movers 2022 release we have used the 12-month period from 1 January 2021, which represents the first full calendar year since the outbreak of the COVID-19 pandemic.

This differs to our first Market Movers release, where we assessed the 12-month period from 1 April 2020 in order for the assessment to cover a period that was entirely affected by the COVID-19 pandemic, instead of using the whole of 2020, in which there were 2–3 months of ‘normal’ business and 9-10 months of very different circumstances. This does mean there is some overlap between the data in this 2022 release and our 2020-21 release; however, for future releases of Market Movers, we aim to continue to use full calendar years.

Data sources

The data used to generate the Market Movers lists is sourced from Glenigan, Planning Pipe, and local authority planning websites, then vetted and checked by our expert data team. To ensure the accuracy of this research, we have reached out to developers and operators by email, asking for information on planning applications during the time period in question.

Exclusion notes

McCarthy Stone have been excluded from the elderly care home rankings as their applications that include care home beds are part of a mixed-use application where McCarthy Stone are developing the older people’s housing element, and are not involved in the care home element. Likewise, Barchester have been excluded from the older people’s housing rankings list as their applications that include older people’s housing units are part of a mixed-use application where Barchester are developing the care home element, and are not involved in the older people’s housing element.

100% accuracy is difficult to achieve, but our sector-specialist team has worked extremely hard to ensure this research is as accurate as it can be. That being said, please let us know via info@carterwood.co.uk if you think there’s anything that’s not quite right.