A clear need for increased provision

The need to increase provision of specialist housing for older people is clear. By 2040, one in four people in the UK will be over-65, with that segment of our population having grown by 41% in 20 years, to nearly 18m people. This is an enormous elderly demographic, with a wide range of accommodation and care needs.

The need for a corresponding increase in specialist housing for older people is well-documented by policymakers and independent observers alike:

- Planning Practice Guidance on Housing for Older and Disabled People (2019) identifies that housing an ageing population is a vital component of future plans.

- The National Planning Practice Framework (NPPF) clearly specifies that the needs of different groups – including older people – should inform the size, type, and tenure of housing that is made available.

- The House of Commons Commission for Long Term Care ‘Housing for Older People Second Report of Session 2017-19’ (2018) states: ‘We believe that, in the face of demand, there is a shortfall in supply of specialist homes in general and particularly for private ownership and rent and for the “middle market”’.

- The Centre for the Study of Financial Innovation (CSFI) (2020) recently highlighted the chronic shortage of suitable accommodation into which older households can downsize, which is causing increasing under-occupation of existing general housing stock, as our elderly population grows. This constricts the supply of homes, especially for families, with knock-on effects up and down the housing ladder.

The recent ‘Chain Reaction’ report suggested that approximately 3 million people in the UK over the age of 65 want to downsize and specialist developments can be the key to a healthy and happy retirement. During the pandemic, retirement housing has kept many older people safe and, when compared with the impact on residential care homes, it is likely that housing with care will become an increasingly attractive alternative.

New provision of private older people’s housing (GB)

ARCO’s ambition is for 250,000 people to have the opportunity to live in retirement villages by 2030. This is based on the growth in the sector to date (with current provision for circa 75,000 people) and the belief that the UK’s health and social care systems need more of the unique support that retirement communities provide.

The Housing and Care for Older People report (2020) highlighted that England and Wales delivered 3,500 units of housing with care each year between 2015 and 2019, which was a considerable improvement on previous years, but one that is dwarfed by both the 19,000 units per year that would be required to meet with ARCO’s 2030 ambition and the 45,000+ units per year for the UK to close the gap in provision compared with other countries.

Types of specialist housing for older people

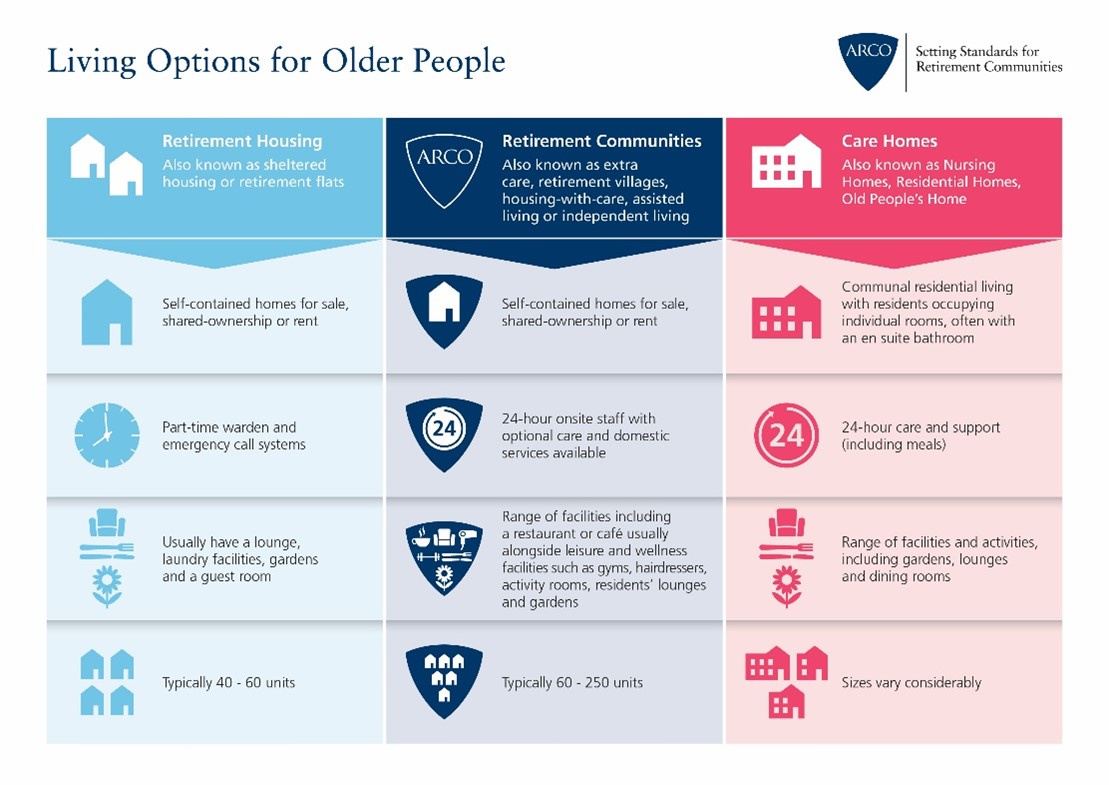

Specialist housing for older people in the UK falls into three broad categories, with traditional retirement/sheltered housing at one end of the spectrum, nursing and residential care in a care home at the other, and a variety of ‘housing-with-care’ models in the middle.

Figure 1: Living options for older people. Source: ARCO.

Traditional retirement housing or sheltered housing, of which there are around 444,000 units in the UK, is a well-established and well-recognised form of specialist housing. These self-contained homes benefit from some basic services but offer little in the way of care or domestic support.

At the other end of the spectrum, care homes provide 24-hour care for residents occupying individual rooms in a communal living setting. Also a well-established model, there are around 460,000 care home beds for the elderly in the UK, distributed across approximately 11,000 homes.

In the middle, housing-with-care models such as ‘extra care’ or ‘enhanced sheltered housing’ provide residents with the independence that comes with owning/renting their own home, while also providing on-site support services and care that caters to their changing needs.

Unlike traditional retirement housing and care homes, housing with care is a relatively immature model in the UK. It is not always fully understood by either policy makers or the potential resident market, and comprises a much smaller share of specialist housing for older people, with only around 78,000 units.

A focus on private older people’s housing

In this article, we explore the new supply within private older people’s housing in the UK, between 2017 and 2020, and look in particular at if these new units are with or without care. Our analysis includes all schemes that consist of, or contain, private tenure units (those classed by the EAC as leasehold, freehold or for rent) and excludes affordable tenure unites (those classed by the EAC as shared ownership, social rent, or licence).

New private older people’s housing schemes and units per year (UK)

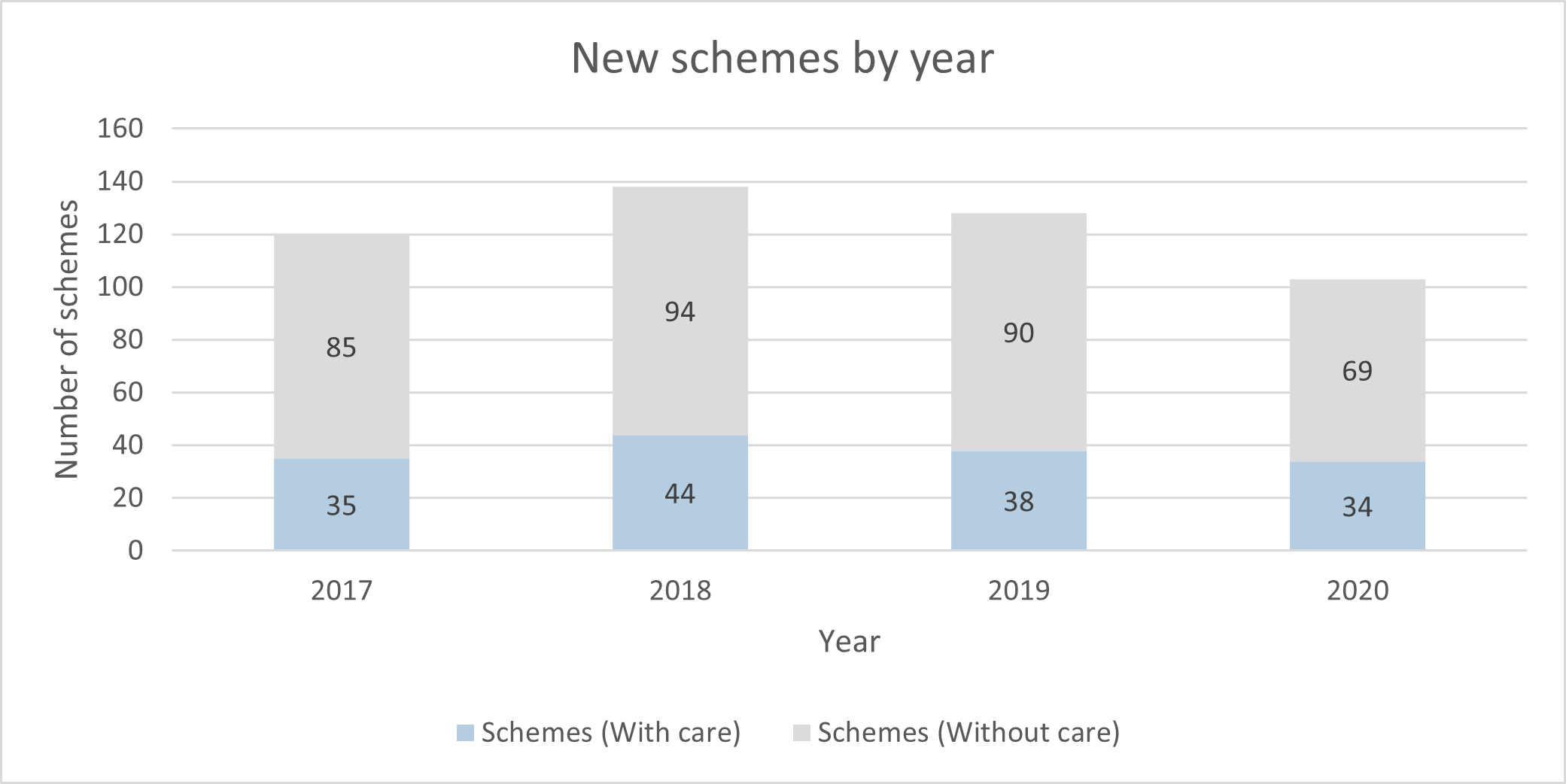

Over the past 4 years, the largest year-on-year growth in the number of new schemes opened was seen in 2018, with a 15% increase from 2017. Following which, the number of new schemes launched into the market has declined, first by 7% between 2018 and 2019, and then by 19.5% between 2019 and 2020. Undoubtedly, this sharp most recent decline is inextricably linked to the impacts of the pandemic laying unforeseen challenges at the feet of developers and operators.

Figure 2a: New private older people’s housing schemes by year (UK)

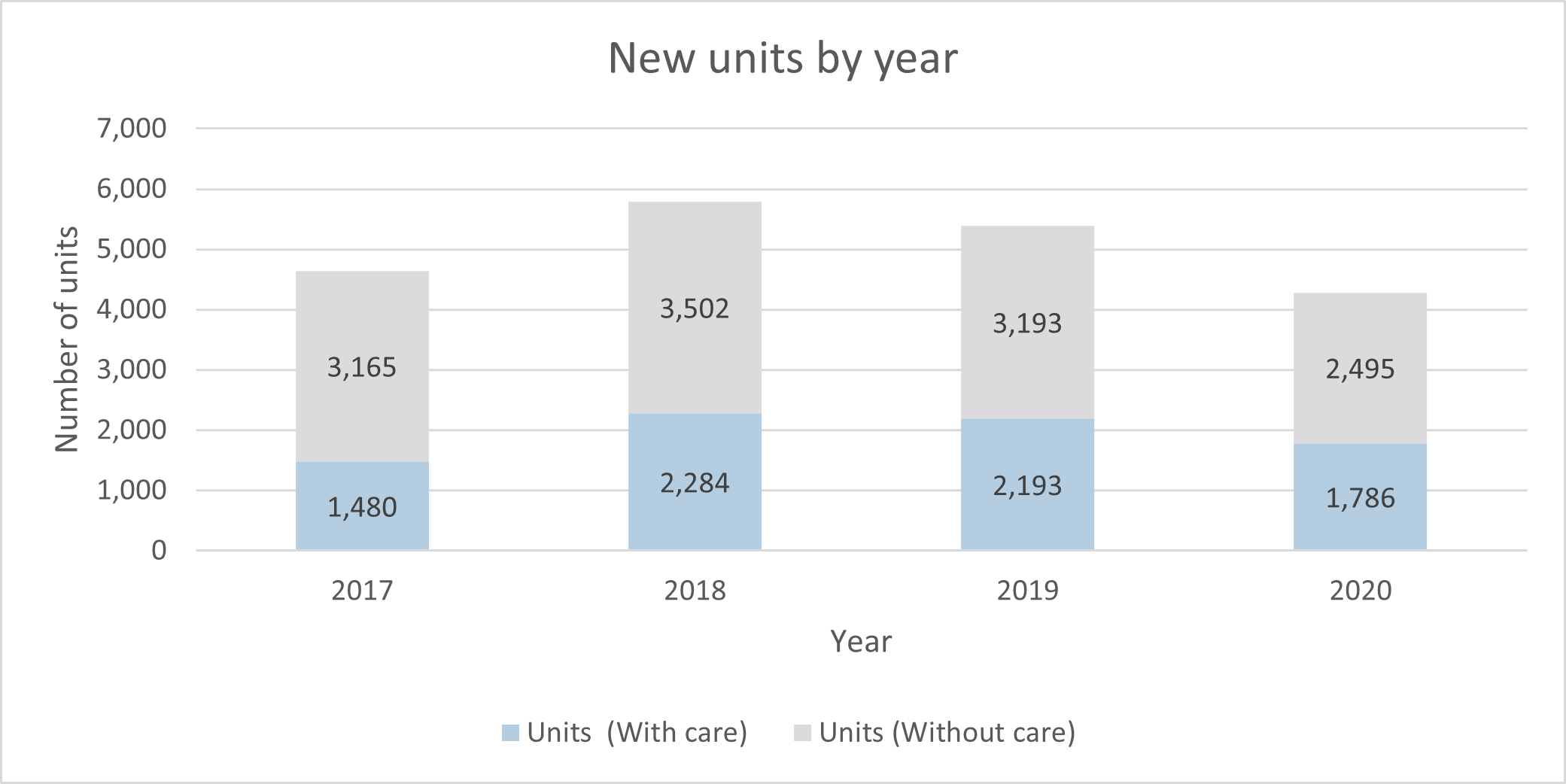

Figure 2b: New private older people’s housing units by year (UK)

These figures are a far cry from the figures of the 1970s and 1980s, when the development of specialist housing for older people was at its strongest and levels of 30,000 new units per annum were reached, although a significant proportion of this supply was affordable stock. New development reduced during the 1980s and 1990s but has now returned closer to 10,000 units per year, with the above data showing just how clearly significant acceleration in development is needed if we’re to meet the needs of our ageing population.

When taking a closer look at the provision of care, year after year, the development of schemes without care dominates the market. The balance between the development of schemes with care and without care has remained consistent over the past few years, with limited fluctuation. Schemes with care account for an average of 31% of new developments, with schemes without care accounting for the remaining 71%.

Regional distribution of private older people’s housing (UK)

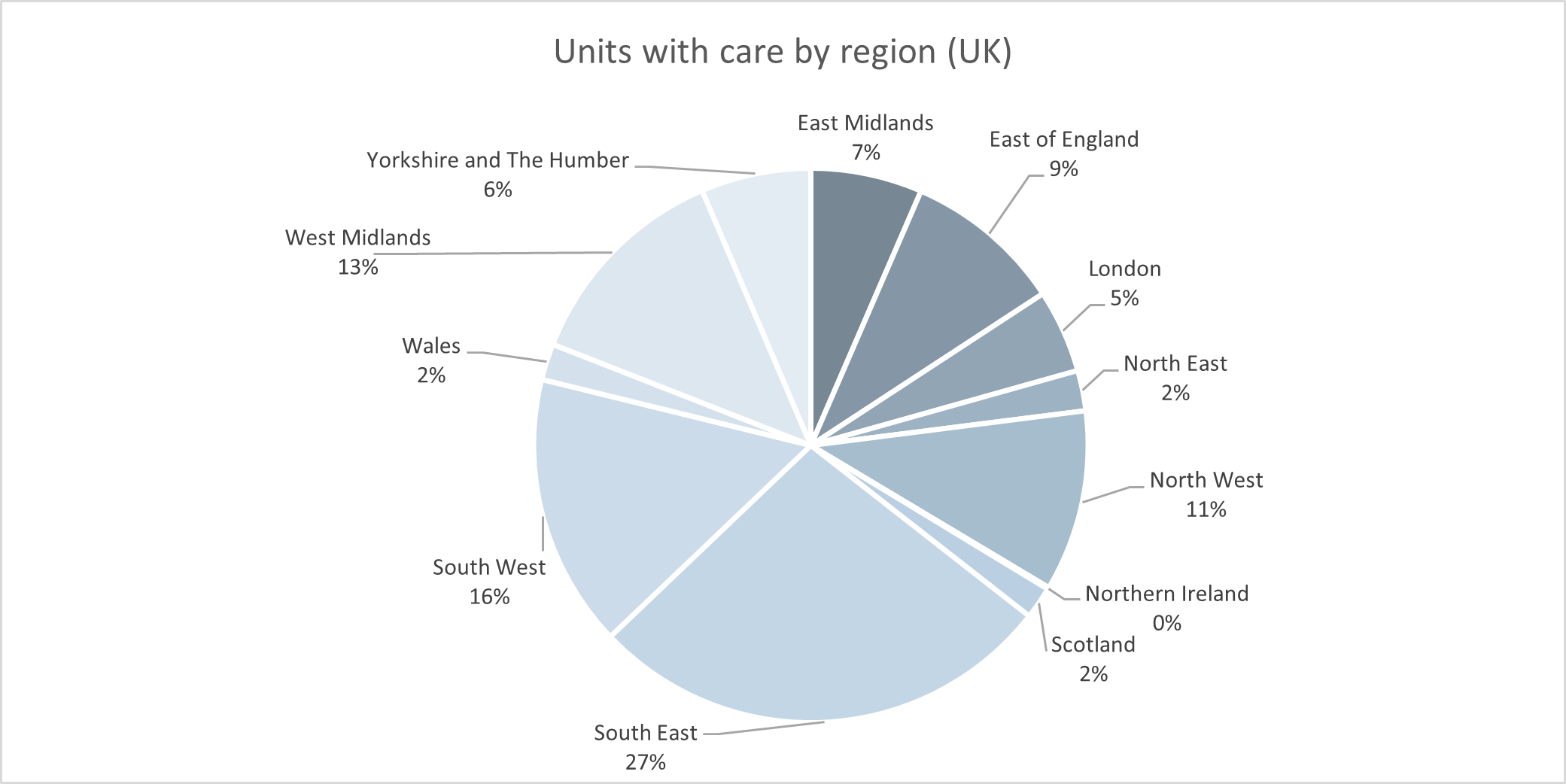

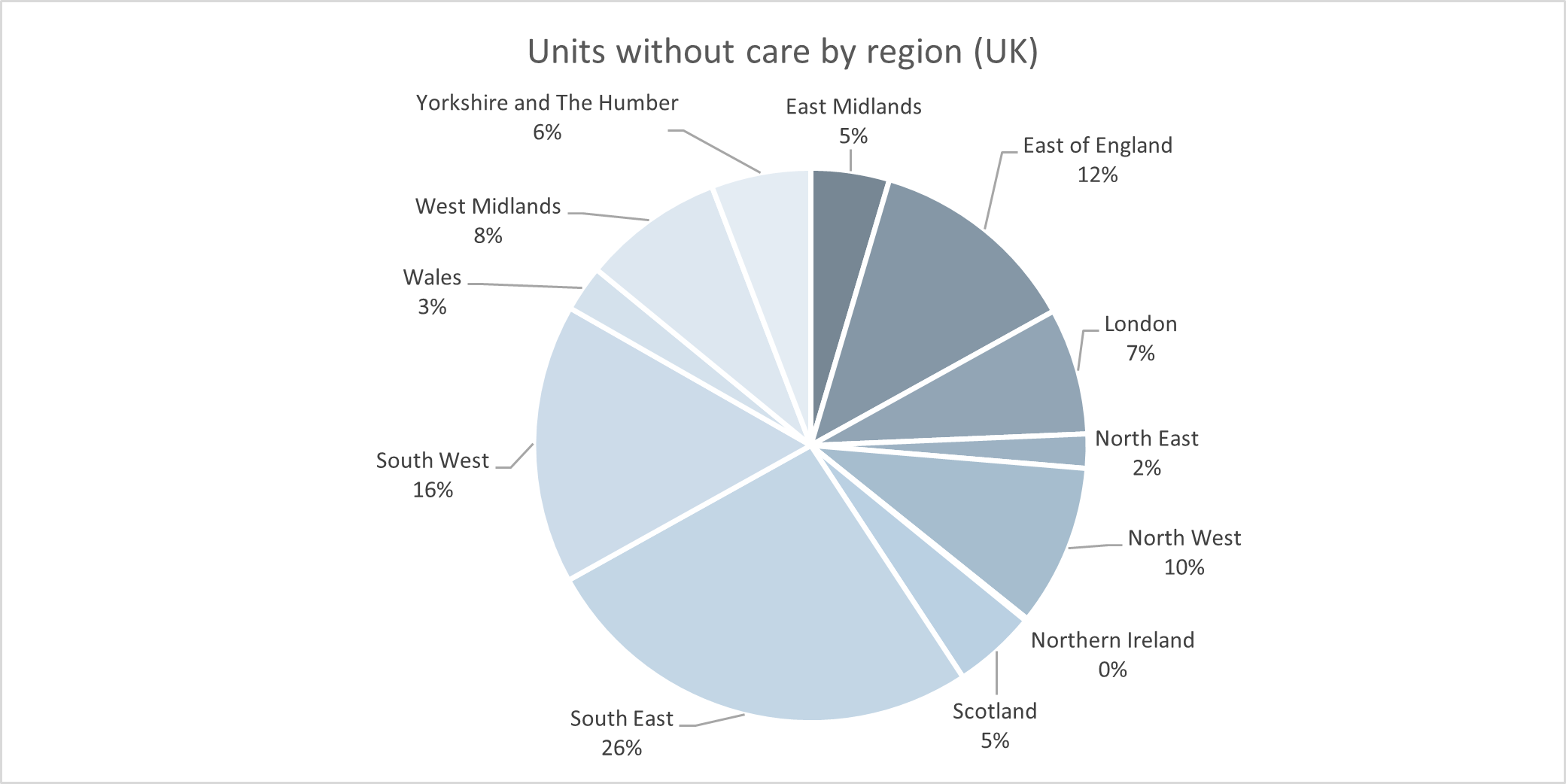

We now turn to the regional distribution of the private older people’s housing supply across the UK, which shows a similar spread regardless of whether we look at units with or without care. Across both care options, the South East dominates the market, accounting for just over a quarter of the supply across the UK, leading the way for the South East and South West combined to hold 42.5% of the total UK supply.

Figure 3a: Private older people’s housing supply by region, with care (UK)

Figure 3b: Private older people’s housing supply by region, without care (UK)

Throughout England and Wales, the average size of scheme remains consistent, with the average scheme with care offering 40–52 units, and the average scheme without care offering 30–35 units. Scotland and Northern Ireland’s average scheme sizes buck these trends, in opposite directions, with Scotland’s average scheme size being far greater (77 with care/ 42 without care), and Northern Ireland’s average scheme being far more modest in size (30 with care/ 21 without care).

When comparing the average age of schemes, there is great regional variation between schemes with and without care. The London market offers the youngest stock of schemes with care, with the median year of opening being 2012, compared to Northern Ireland with the oldest stock (2005). Schemes without care are considerably older throughout all regions, with variances ranging from 1927 (Northern Ireland), to 1996 (the North East, Yorkshire and The Humber).

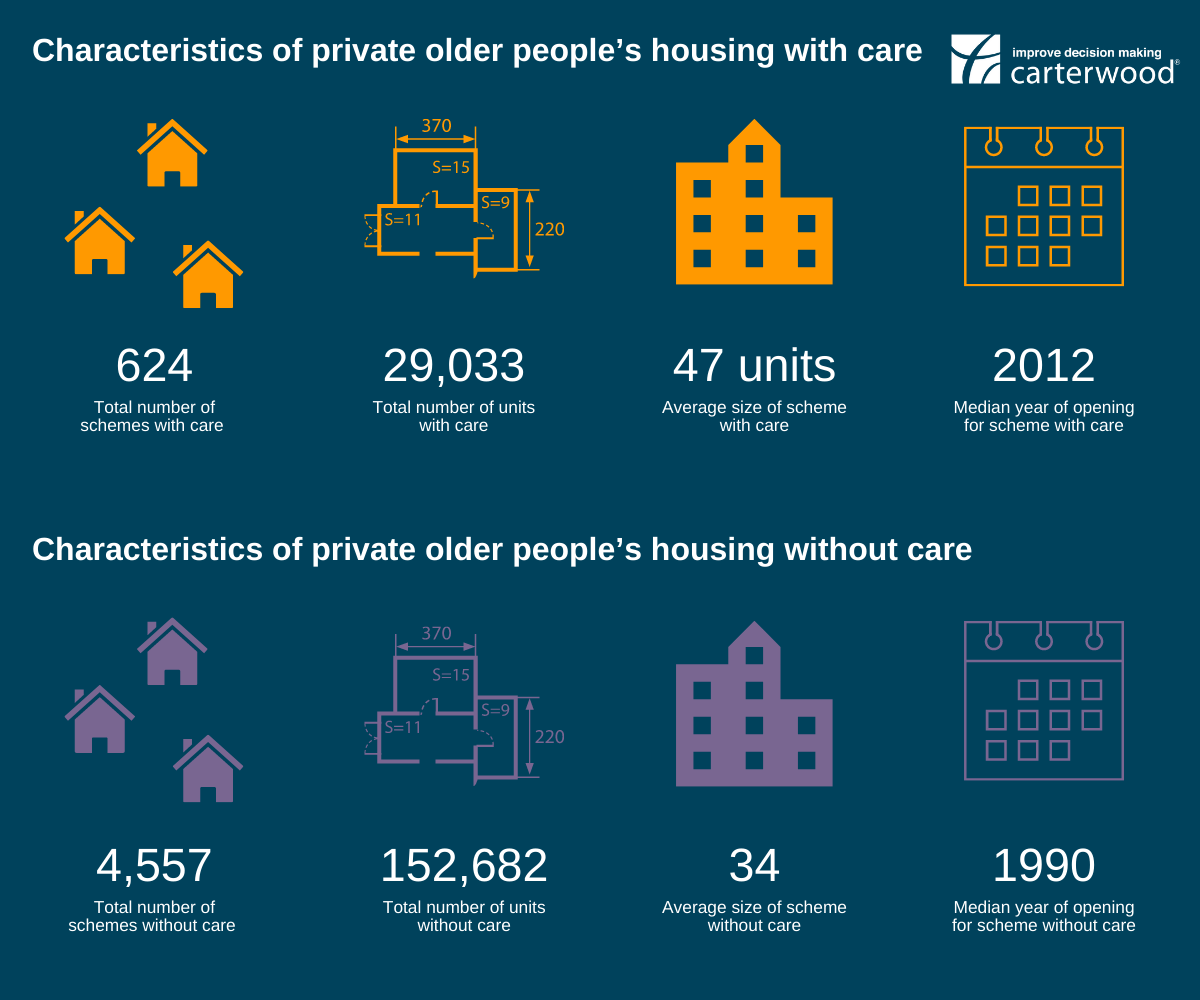

Characteristics of private older people’s housing – with and without care

A snapshot of the characteristics of private older people’s housing throughout the UK, both with and without care, provides a clear picture of the market. As we saw from the year-on-year figures for new supply (Figure 2, above), private older people’s housing without care dominates the supply, with a far greater number of schemes and units. This dominance results in private older people’s housing with care, a relatively new form of specialist housing, accounting for just 12% of all schemes and 16% of all units within the market, although these schemes have a higher average size and are typically much younger stock than schemes that do not offer care.

As reflected in Figure 1, private housing with care schemes characteristically offer residents a wider and more diverse range of facilities and services to promote health and well-being. In addition to the availability of accessing care and domestic services, these schemes feature onsite facilities for residents and guests alike, such as restaurants or cafés, leisure and wellness facilities, and activity rooms, lounges, and gardens.

These facilities and services allow housing with care in the private sector to be a preventative solution to otherwise unsuitable domiciliary care or premature care home placement. Older people, when able to acquire a private housing with care unit prior to requiring 24-hour care and support, can age in place, safe in the knowledge that if their health deteriorates, their increasing care needs can be effectively met within their own home. Housing with care is not, therefore, just a replacement for residential care, it is an accommodation type suitable for a far larger segment of the population, provided it is accessed at the correct time.

Figure 4: Characteristics of private older people’s housing with care and without care (UK)

Developing for the future with Carterwood Analytics – Retirement Living

With sound knowledge of both where the market has been and where it is now, we are now faced with the challenge of meeting the demands of the future. ARCO’s Housing and Care for Older People report (2020) suggests that new development should be between 5 and 6 times current rates to ensure the UK makes adequate improvements in penetration rates.

So, how can we help you get there?

We understand that tracking down retirement living sales data can be an arduous task, but you can’t make good decisions without access to accurate information – that’s where Carterwood steps in!

Our new online platform gives retirement living operators, developers, and investors access to a proprietary database, providing essential data needed to assess the viability of new retirement living schemes quicker, improve sales velocity, and maximise sale/resale rates.

Covering more than 500 retirement developments across Great Britain, from over 30 of the top operators and developers in the UK, our new platform includes detailed data for over 26,000 individual new and resale properties.

With a range of sector-specific features and tools, we believe this market-leading data will empower our clients to:

- Smash their sales targets with detailed comparables, scheme by scheme sales history/velocity, and pricing predictor

- Save time finding the best locations with instant access to data on qualifying households, existing supply, demographics and future supply

- Stay ahead of their key competition by monitoring existing and future supply across Great Britain, broken down by location, operator, or scheme type

Want to find out more?

Tap into a wealth of essential market data, available on our new market-leading platform and ready for you to access today

Get in touch to find out more, sign up to a free trial and book a demo.

Visit staging.carterwood.flywheelsites.com/analytics-retirement-living/

Email sales@carterwoodanalytics.co.uk

Methodology

Where schemes have a mix of private and non-private tenure, we calculate the balance through our site inspections and planning application data. Where we do not have exact information in terms of the tenure breakdown at a scheme, we will typically assume an even split between tenures and allocate between private and affordable units accordingly.

Sources

- Ministry of Housing, Communities & Local Government (2018). Government response to the Second Report of Session 2017-19 of the Housing, Communities and Local Government Select Committee inquiry into Housing for Older People. [pdf], Section 28. p.16. Online, available at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/930855/CM_9692_Housing_for_Older_People_web_version.pdf [Accessed 11 August 2021]

- The Centre for the Study of Financial Innovation (2019). The Last-Time Buyer: housing and finance for an ageing society, p.1.

- Stirling, P and Burgess, G (2021) Understanding supply, demand and investment in the market for retirement housing communities in England. Cambridge Centre for Housing & Planning Research and Places for People.

- Chain reaction – the positive impact of specialist retirement housing on the generational divide and first time buyers (2020) WPS Strategy and Homes for Later Living.

- Housing, Communities and Local Government Committee (2021) The future of the planning system in England. House of Commons.

- Vision 2030. ARCO.

- Housing and Care for Older People (2020) British Property Federation and Cushman and Wakefield.