Carterwood’s Market Movers is back!

Returning for a third year, our Carterwood Market Movers research celebrates those who are aiming to redress the pressing supply and demand imbalance in the elderly care home and retirement living sectors with their new planned developments.

Our goal is unchanged, we want to highlight the organisations that are poised to bring essential new capacity to sectors that urgently need it.

Ultimately, our Market Movers research ranks developers and operators by planning activity in the elderly care home and retirement living sectors over the most recent full calendar year. So, we’ve reviewed our planning data and updated our research for the period 1 January 2022 to 31 December 2022 and are pleased to reveal Carterwood’s Market Movers 2023.

Click here for a full breakdown of our methodology.

Quick links:

- Market context

- Meet our elderly care home Market Movers 2023

- Meet our retirement living Market Movers 2023

- Market Movers 2023: What’s moved?

- Let’s fast-track your growth plans

- Previous Market Mover releases

- Methodology

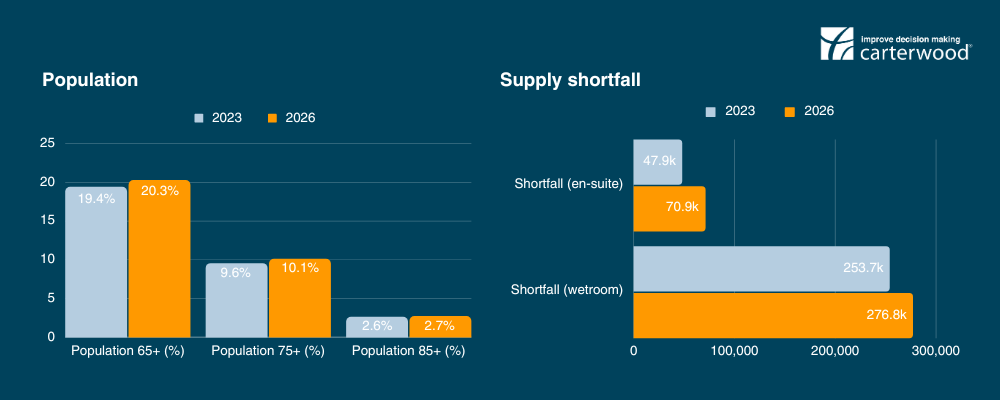

Market context

As ever, the elderly care home market in Great Britain demonstrates strong fundamentals: we have a rapidly growing elderly population and a significant shortfall in fit for purpose, futureproofed accommodation.

These underlying strengths will undoubtedly help the sector to weather the current stresses and strains it is experiencing: occupancy has only just recovered to pre-pandemic levels in Q1 2023; severe staffing issues persist; and inflationary cost pressures have made trading conditions extremely challenging over the last year.

The purpose of our Market Movers research is to shine a spotlight on those who have invested time, energy, and capital into development plans that will drive the sector forward and help to futureproof it against the evolving needs of our elderly population, and the environmental, sustainability and governance requirements of funders.

Don’t forget, you can track the essential elderly care home market statistics for Great Britain through our Carterwood Index.

Meet the elderly care home Market Movers 2023

When it comes to ranking our Market Movers, we have chosen to rank our elderly care home and retirement living Market Movers by the number of beds/ units included in the planning applications that met our criteria, which enables us to identify those developers and operators who are bringing the greatest potential bed capacity to the sector. For shortlisting purposes, we have only included organisations with 100 or more elderly care home beds/ retirement living units represented across their applications.

Table 1: Elderly care home sector Market Movers ranked by number of beds

| Rank | Applicant | Total applications (2022) | No. of beds | Average size |

|---|---|---|---|---|

| 1 | LNT Care Developments | 28 | 1842 | 66 |

| 2 | Frontier Estates Ltd | 11 | 718 | 65 |

| 3 | Barchester Healthcare Ltd | 14 | 603 | 60 |

| 4 | Avery Healthcare Group | 7 | 519 | 74 |

| 5 | Aspire LPP | 7 | 481 | 69 |

| 6 | Country Court Care | 9 | 428 | 66 |

| 7 | Montpelier Estates | 6 | 402 | 67 |

| 8 | North Bay | 6 | 383 | 74 |

| 9 | Care Concern | 6 | 303 | 72 |

| 10 | Perseus Land & Developments | 4 | 277 | 69 |

| 11 | Tarmac Trading Ltd | 3 | 270 | 90 |

| 11 | Muller Property Group | 4 | 270 | 68 |

| 12 | Signature Senior Lifestyle Ltd | 3 | 265 | 88 |

| 13 | Hallmark Care Homes | 4 | 262 | 66 |

| 14 | Urban Village Group | 3 | 245 | 82 |

| 15 | MACC Care | 3 | 237 | 79 |

| 16 | McCarthy Stone | 3 | 230 | 77 |

| 17 | SM Planning | 3 | 226 | 75 |

| 18 | Halebourne Group Ltd | 3 | 210 | 70 |

| 19 | Liberty Care Developments | 3 | 206 | 69 |

| 20 | Northcare Ltd | 3 | 196 | 65 |

| 21 | Simply UK | 3 | 192 | 64 |

| 22 | Parklands Developments Ltd | 3 | 160 | 53 |

| 23 | Runwood Homes Ltd | 3 | 159 | 60 |

| 24 | Care Build Group Ltd | 2 | 150 | 75 |

| 25 | NL Property Ltd | 2 | 147 | 74 |

| 25 | Hamberley Development | 2 | 147 | 74 |

| 25 | Care UK | 2 | 147 | 74 |

| 26 | NHS Property Services Ltd | 2 | 142 | 71 |

| 27 | Morrison Community Care Ltd | 2 | 138 | 69 |

| 28 | Zos Ltd | 1 | 131 | 131 |

| 29 | Stantec | 1 | 128 | 128 |

| 30 | Dandara Jersey Ltd | 1 | 127 | 127 |

| 31 | Medici Westminster Limited | 1 | 126 | 126 |

| 32 | Prosperity Developments Ltd | 2 | 120 | 60 |

| 32 | Taylor Wimpey | 2 | 120 | 60 |

| 32 | 65 Hampden Road Limited | 1 | 120 | 120 |

| 33 | Minster Care Group | 5 | 118 | 41 |

| 34 | LifeCare Residences Limited | 2 | 105 | 53 |

| 34 | Hartford Care | 4 | 105 | 68 |

| 35 | Cheldon Barton Ltd | 1 | 100 | 100 |

| 35 | RAS Ltd | 1 | 100 | 100 |

*Average size only relates to new homes; extensions are excluded from this datapoint, but are included in the total new beds number.

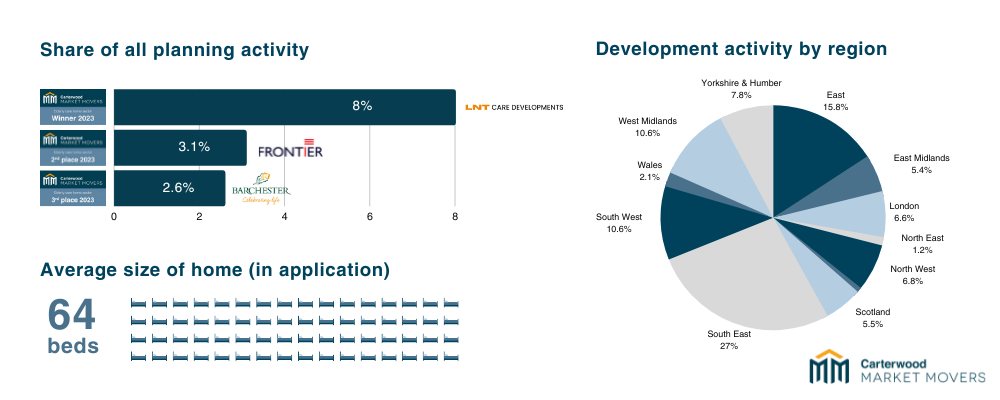

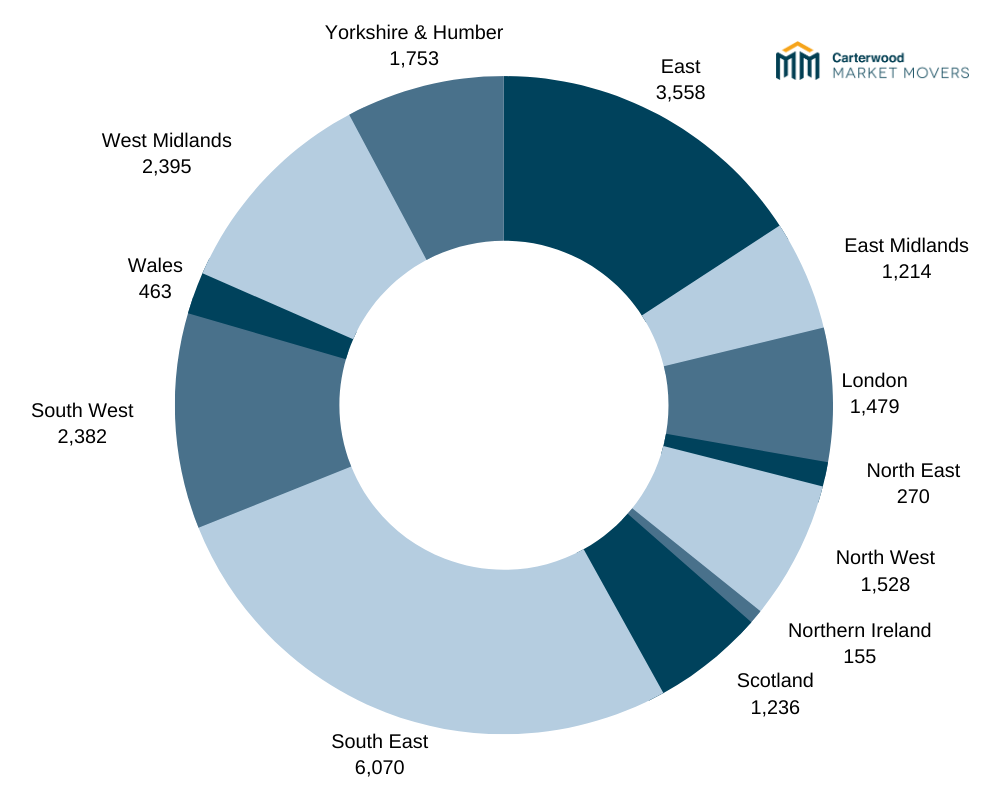

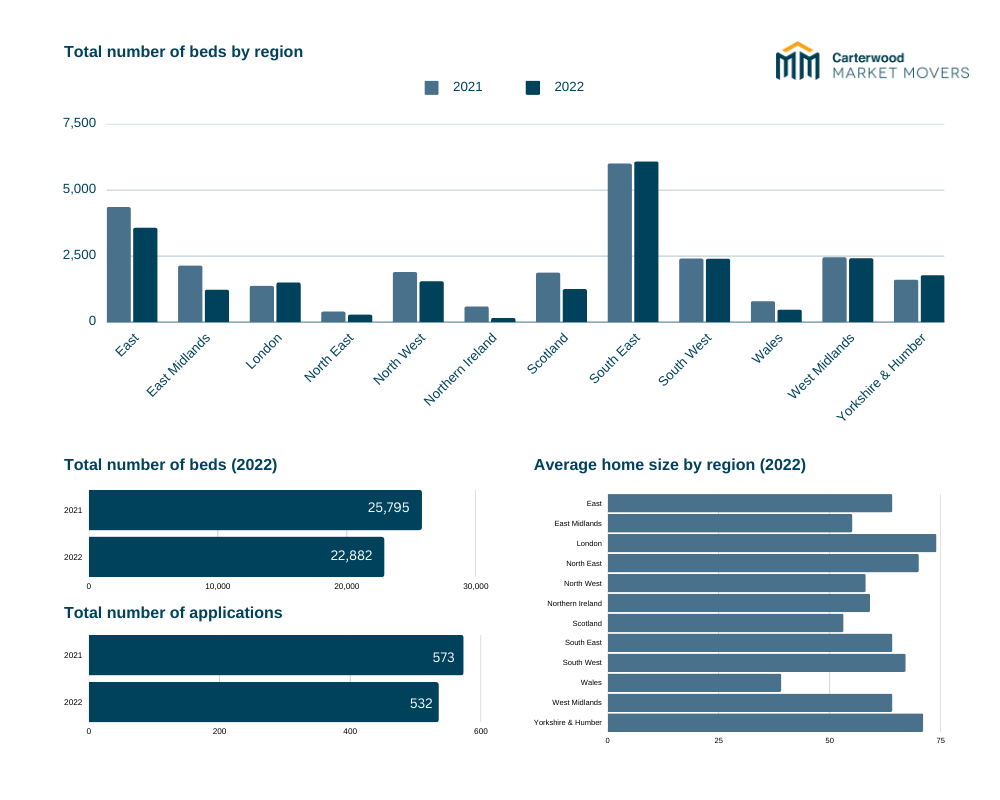

Elderly care home development activity by region (2022)

Carterwood’s top 3 elderly care home Market Movers 2023

Meet the retirement living Market Movers 2023

Table 2: Retirement living sector Market Movers ranked by number of units

| Rank | Applicant | Total applications (2022) | No. of units | Average size |

|---|---|---|---|---|

| 1 | McCarthy Stone | 47 | 2477 | 54 |

| 2 | Churchill Retirement Living | 26 | 1265 | 49 |

| 3 | Inspired Villages | 8 | 942 | 148 |

| 4 | Aylesford Heritage Limited | 1 | 400 | 400 |

| 5 | Retirement Villages Ltd | 2 | 366 | 183 |

| 6 | Redrow Homes | 1 | 290 | 290 |

| 7 | Tarmac Trading Ltd | 3 | 270 | 90 |

| 8 | Audley Retirement | 3 | 266 | 132 |

| 9 | Prospection | 1 | 240 | 240 |

| 10 | Beechcroft Developments Ltd | 5 | 235 | 47 |

| 11 | SGN Mitheridge Ltd | 1 | 224 | 224 |

| 12 | Homes England | 4 | 215 | 50 |

| 13 | Colchester Borough Council | 1 | 210 | 210 |

| 13 | Castle Meadow Care | 1 | 210 | 210 |

| 14 | Socius Developments Ltd | 1 | 205 | 205 |

| 15 | LifeCare Residences Limited | 2 | 202 | 101 |

| 16 | Cornwall Council | 1 | 200 | 200 |

| 17 | Senior Living | 1 | 182 | 182 |

| 18 | Marstead Peak Ltd | 1 | 175 | 175 |

| 19 | Anchor | 2 | 168 | 84 |

| 20 | Northumberland Estates | 1 | 167 | 167 |

| 21 | Rishco Leisure Ltd | 1 | 162 | 162 |

| 22 | Symphony Park Holdings Ltd and Alderley Park Ltd | 1 | 159 | 159 |

| 23 | Axis Land Partnerships | 1 | 147 | 147 |

| 23 | Birkdale Retirement Village Ltd | 1 | 147 | 147 |

| 23 | Mr Mac Khan | 1 | 147 | - |

| 24 | Raybridge Corporation | 1 | 142 | 142 |

| 24 | Grosvenor Estate | 1 | 142 | 142 |

| 25 | Lifestyle Care and Community Ltd | 2 | 130 | 65 |

| 26 | Advanced Living (Kingston) Limited | 1 | 128 | 128 |

| 27 | Mr Stephen Vigar | 1 | 125 | 125 |

| 27 | Kingacre Estates Ltd | 1 | 125 | 125 |

| 28 | Castleoak | 1 | 124 | 124 |

| 29 | St Christophers Propco Ltd | 1 | 122 | 122 |

| 30 | Xiros Plc | 1 | 121 | 121 |

| 31 | Prosperity Developments Ltd | 2 | 120 | 60 |

| 31 | St Modwen Developments Ltd | 2 | 120 | 60 |

| 32 | Ecosse Regeneration | 1 | 116 | 116 |

| 33 | Birchgrove | 2 | 115 | 58 |

| 33 | Elysian Henley LP | 1 | 115 | 115 |

| 34 | Angle Property Ltd | 1 | 112 | 112 |

| 35 | Mr S Paul | 1 | 106 | 106 |

| 36 | Taylor Wimpey | 1 | 100 | 100 |

| 36 | Mr. Jonathan Pillow | 1 | 100 | 100 |

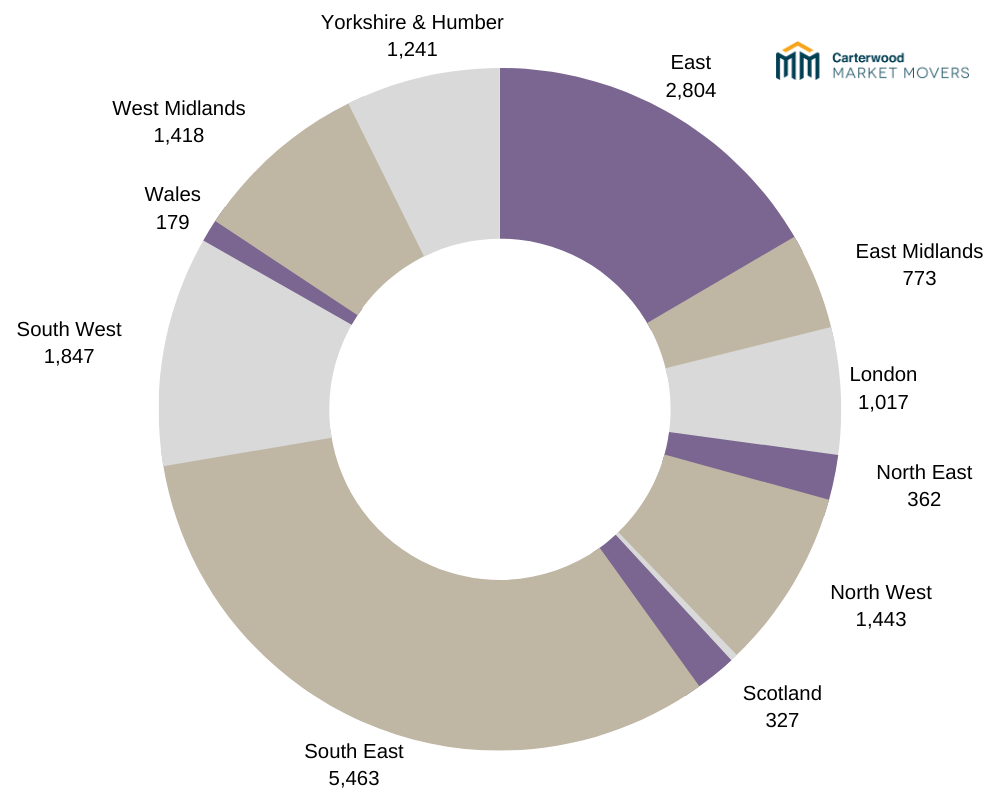

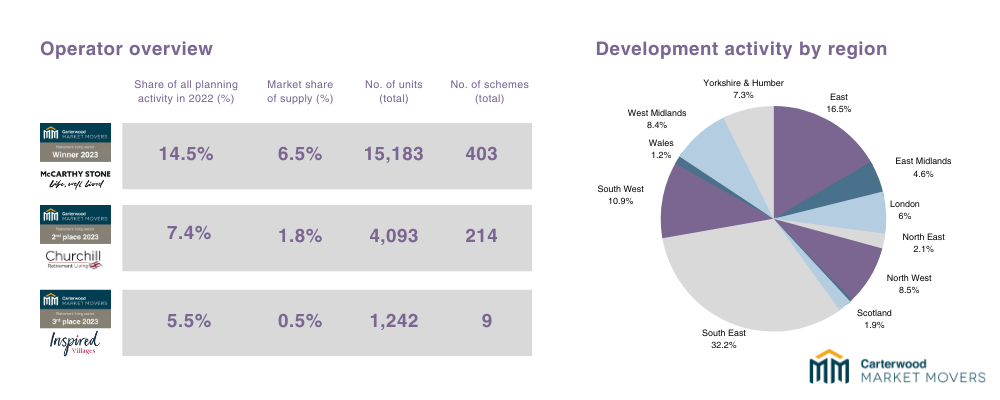

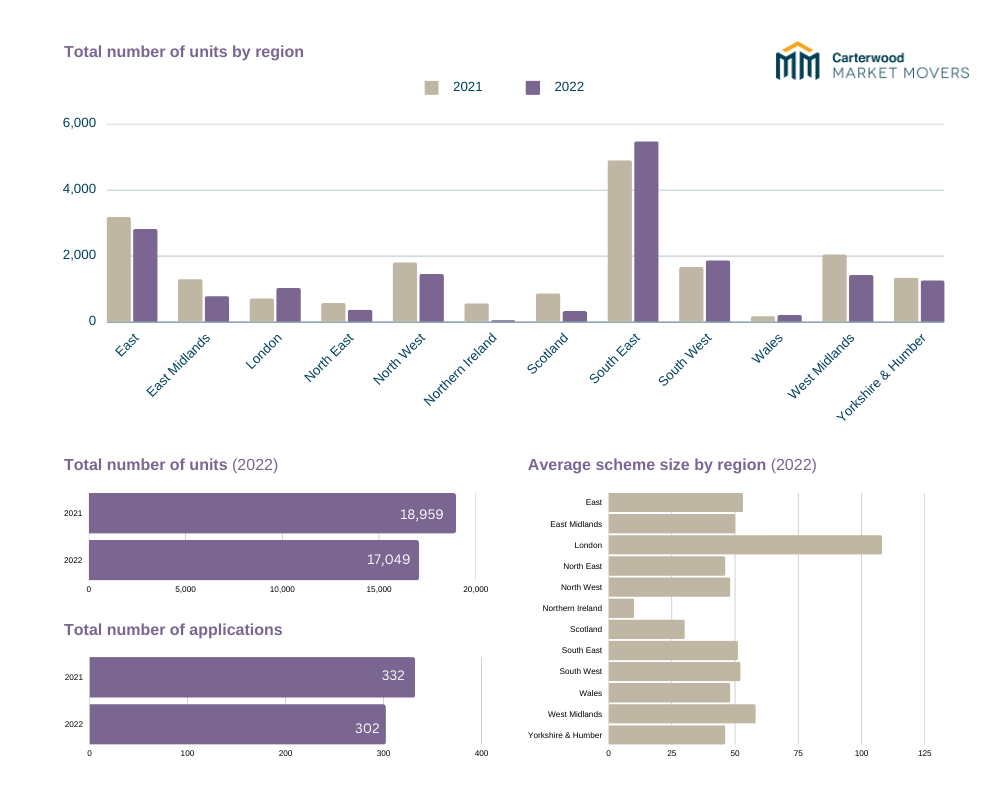

Retirement living development activity by region (2022)

Carterwood’s top 3 retirement living Market Movers 2023

Market Movers 2023: What’s moved?

Elderly care home sector

Retirement living sector

Let’s fast-track your growth plans

Whether you have your next development project in sight or are still seeking the right opportunity to complement your portfolio, we are here to support you with the next step of your journey with our award-winning advisory services.

Discover our services for the elderly care home sector

Discover our services for the retirement living sector

Let our team support your decision-making with market-leading data and sector expertise.

- Need to make a quick decision on whether an opportunity ticks all the right boxes?

- Found the development opportunity, but need added security and confidence before proceeding?

Get in touch to start the conversation that could get your growth plans off to the flying start they deserve.

Contact Form

Fancy a reminder of our previous Market Movers releases?

For a refresh of who made the shortlist in 2020-2021 and 2022, simply click below.

Methodology – What makes a Market Mover?

Our Market Movers 2023 research ranks developers and operators by planning activity in the elderly care home and retirement living sectors over the 12-month period of 1 January 2022 to 31 December 2022.

For a planning application to qualify for inclusion in this edition of the Carterwood Market Movers, it had to have been validated in the United Kingdom and:

- Have been granted permission during the period 1 January 2022 to 31 December 2022 (please note: this includes applications validated prior to this period, but granted during it)

OR

- Have been validated during the period 1 January 2022 to 31 December 2022, and still be pending a decision (please note: this includes pending appeals, but does not include refused applications with no appeals).

Other factors:

- Planning applications for both new homes/schemes and extensions are included in the figures when ranking by number of beds.

- An elderly care home planning application is defined as: any application for additional care home beds for the elderly that will be registered with a regulatory body (CQC, RQIA, SCI and CIW).

- A retirement living housing planning application is defined as: any application for new units of older people’s housing, covering housing with and without care (falling in both C2 and C3 uses), including everything from age exclusive/sheltered housing to extra care/close care.

Data sources

The data used to generate the Market Movers lists is sourced from Glenigan, Planning Pipe, and local authority planning websites, then vetted and checked by our expert data team. To ensure the accuracy of this research, we have reached out to developers and operators by email, asking for information on planning applications during the period in question.

100% accuracy is difficult to achieve, but our sector-specialist team has worked extremely hard to ensure this research is as accurate as it can be. That being said, please let us know via info@carterwood.co.uk if you think there’s anything that’s not quite right.