Following on from the release of our housing with care planning research (which is available upon request here), Carterwood have been tracking the number of granted new build applications that have since begun construction or have been completed in the UK. This research explores the development status of new build applications that were validated in 2017 and subsequently granted planning permission. Using 2017 as our base year of analysis accommodates the sometimes sizeable gap between planning permission being granted and development starting.

Quick links

- Development status of new build housing with care schemes that were validated in 2017 and have subsequently been granted

- Our thoughts on the data and the factors affecting development

- Award-winning support from Carterwood

- Full dataset

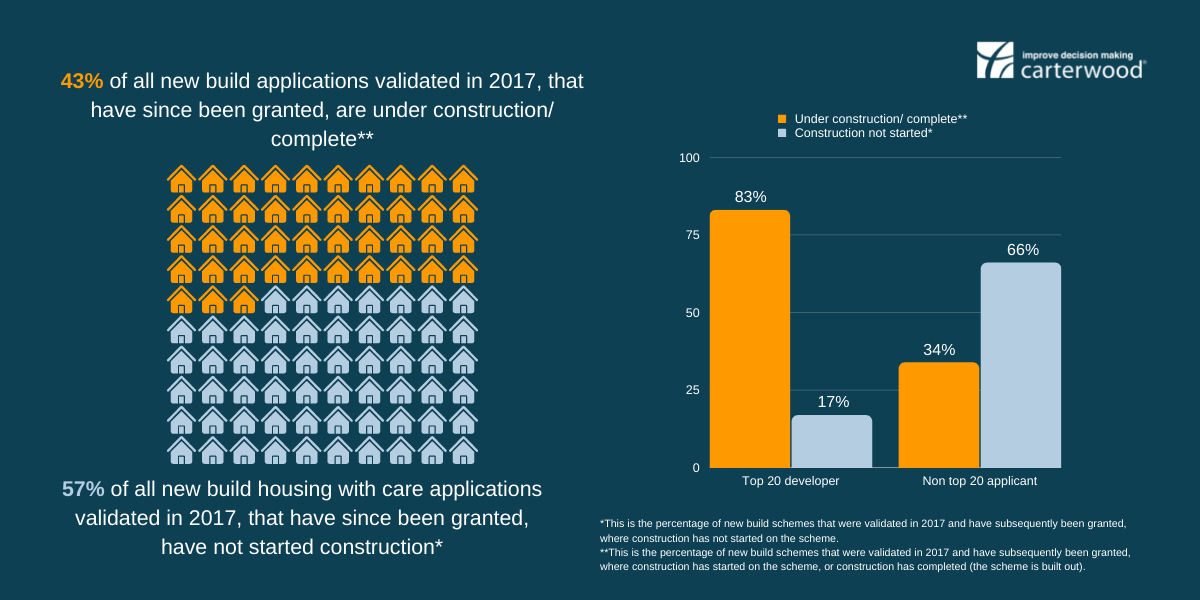

Table 1: Development status of new build housing with care schemes that were validated in 2017 and have subsequently been granted, UK

| All granted applications | Top 20 developers | Non top 20 applicants | |

|---|---|---|---|

| Construction not started* | 57% | 17% | 66% |

| Under construction/ complete** | 43% | 83% | 34% |

*This is the percentage of new build schemes that were validated in 2017 and have subsequently been granted, where construction has not started on the scheme.

**This is the percentage of new build schemes that were validated in 2017 and have subsequently been granted, where construction has started on the scheme, or construction has completed (the scheme is built out).

There is an interesting contrast between the top 20 developers* and non-top 20 applicants** when it comes to the percentage of schemes with planning permission that go on to be developed. By the middle of 2022, both top 20 developers and non-top 20 applicants have had a similar percentage of their 2017 applications granted (88% and 84% respectively), yet construction has started/completed on 83% of these granted applications for top 20 developers, whilst the figure for non-top 20 applicants sits at only 35%.

*Developers of specialist housing schemes for the elderly where care is available on site, ranked by those with the highest volume of open and operational supply on the market.

**All applicants who are not classed as top 20 developers, including applicants who may not be developers of specialist housing schemes for the elderly where care is available on site.

Jessamy Venables, director at Carterwood, who is a specialist in planning need for the housing with care sector and leads our team in providing our range of planning reports, offers her thoughts on the data, the factors affecting development and why top 20 developers are able to progress onto development quicker than others…

The strength of the top 20 developers

It is clear that, when it comes to getting a development with planning permission across the line and into the construction phase, the top 20 developers are far more likely to have the benefits of experience and scale, which are usually more difficult for more ad hoc developers, outside the top 20.

Developers within the top 20 are more likely to:

- Have an established team around them, often including in-house specialists, reducing the need for outsourcing, which can often slow projects down.

- Benefit from more cumulative years of sector specialist knowledge, having developed a higher number of schemes, and have access to market-leading data.

- Have the advantage of hindsight, with a portfolio of developments under their belt and knowledge on what planners and local authorities are looking for, which allows them to prepare accordingly.

- Have experience in engaging local communities more effectively, with the ability to show examples of existing developments.

- Be practiced in moving projects forward at pace, with tried and tested methods of construction and contractors readily engaged to make the next move.

Another key consideration is that top 20 developers will often operate their own schemes or will have strong links to operators who will operate their developments, commonly before they go to planning. This saves the developer precious time in searching for an operator, enabling them to develop their schemes more quickly as they are often designed specifically for the intended operator. Developers who also operate their own schemes reap the benefits of having in depth operational data which can be accessed, where appropriate, to aid new developments. In contrast, some non-top 20 applicants with less operational experience, may be unable to attract an operator for their schemes and so may not go forward with development.

Funding and policy

The concept of housing with care is now more widely understood, with thanks to the work undertaken by ARCO, and this has meant that funding for proposed schemes is more readily available. Developers are therefore more readily able to sell sites to operators, subject to planning permission and this, in turn, has opened more opportunities for operators, benefitting both top 20 developers and non-top 20 applicants.

ARCO membership provides a quasi-regulatory platform to ensure operators meet the high standards expected in the operation of new developments by funders and, importantly, potential residents.

That being said, the top 20 developers are more likely to have longer standing relationships with potential funders, with whom they have built a reputation, and are therefore often better aligned to secure funding for well-located and designed developments than their non-top 20 counterparts.

The development site

Sometimes, due to the cost of land and the fact that retirement village operators are less able to compete with residential developers, it is the physical state or planning status of the site that can lead to a delay. Unlike traditional housebuilders, who more commonly select large, open, and easier to develop sites, housing with care developments can often be planned on more complex sites, even including green belt sites and sites that require remediation work prior to starting construction.

Mixed-use developments

Housing with care schemes can frequently be included as part of a wider mixed-use development where other elements of the overall scheme may need to be developed first to facilitate the required infrastructure. This phased development strategy can mean that the housing with care element is left until the later stages of the scheme.

Non-top 20 applicant’s proposals more frequently form part of an outline permission for a large mixed-use scheme, and in some instances the scheme may be built without the housing with care element. On a similar note, the non-top 20 applicants are less likely to be specialists in the housing with care sector, having stronger links with other sectors and may choose to develop their sites with other uses before, or instead of their housing with care scheme.

The size of the scheme

With smaller schemes often being quicker to begin development, it is worth recognising that in 2017 the average size of a housing with care application was 60 units, which has been increasing, and in 2021 this rose to 79 units. This increase in the average size of schemes has been driven by an increase in the number of planning applications for larger retirement communities, which provide a wide range of amenities and care services.

Confidence in achieving planning permission

Developers who are more confident about the success of their planning application (likely those in the top-20 with a stronger track record and greater sector experience) are more likely to have their funding and building contractors lined up and ready to go, allowing them to start development sooner. Those with less sector experience who are less confident about their application, or who have had their application delayed by lengthy local authority decision times or are facing appeal, will likely wait until planning permission has been received before proceeding with the next steps.

Operators wishing to change plans

Although planning permission may be forthcoming for a potential development, when an operator has not been brought on board at planning stage (more common among non-top 20 applicants), in order for the scheme to meet an end operator’s own specific style/brand of scheme, changes to the agreed plans may be required, which will often delay development. This level of change required and subsequent impact on timescales will depend on whether the original application is outline or full; significant changes will delay the commencement of development.

The future

The concept of housing with care is becoming better known, both across the sector and by the public, thanks to the work that ARCO are doing to raise the profile of this sector by establishing the concept of integrated retirement communities. With this increasing awareness, and demand, for such housing, we hope to see a greater number of schemes being developed out, with a more balanced weighting across all applicants.

The research discussed here reflects the proven pedigree of top 20 developers/operators in converting planning consents into development, often with larger/more experienced teams who are skilled at securing the investment needed to fund development, gaining support from local councils and residents, and engaging the construction teams needed to deliver on time.

Award-winning support from Carterwood

Carterwood are experts in the planning arena for retirement living, to aid decision making throughout the planning process from initial site evaluation and need assessment as part of an application, through to working with you to defend the care need or alternative site position at appeal.

If you would like support from our award-winning team on your next project, please get in touch, we would love to help.

Find out more about our advisory services

Full 2017 dataset

Table 2: New build housing with care planning applications 2017, UK

| All applicants | Total | 147 |

|---|---|---|

| Granted | 120 | |

| Pending | 6 | |

| Refused | 21 | |

| % Granted (of decided applications) | 85% | |

| % Refused (of decided applications) | 15% | |

| % decided (of total) | 96% | |

| Not started | 57% | |

| Under construction/complete | 43% | |

| Non-top 20 applicants | Total | 121 |

| Granted | 97 | |

| Pending | 6 | |

| Refused | 18 | |

| % Granted (of decided applications) | 84% | |

| % Refused (of decided applications) | 16% | |

| % decided (of total) | 95% | |

| Not started | 66% | |

| Under construction/complete | 34% | |

| Top 20 developers | Total | 26 |

| Granted | 23 | |

| Pending | 0 | |

| Refused | 3 | |

| % Granted (of decided applications) | 88% | |

| % Refused (of decided applications) | 12% | |

| % decided (of total) | 100% | |

| Not started | 17% | |

| Under construction/complete | 83% |

Please get in touch with us if you would like to discuss or review the full dataset for subsequent years.